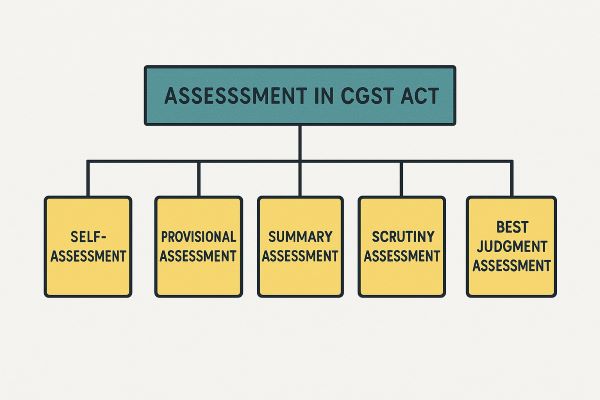

Assessment: Sections 59 to 64 CGST Act, 2017

1. Introduction 1.1. Purpose and Definition of Assessment under GST The Central Goods and Services Tax (CGST) Act, 2017, establishes a comprehensive framework for the levy and collection of tax on intra-State supplies of goods or services or both. A critical component of this framework is the process of ‘assessment’, which, as defined under Section […]

Assessment: Sections 59 to 64 CGST Act, 2017 Read More »