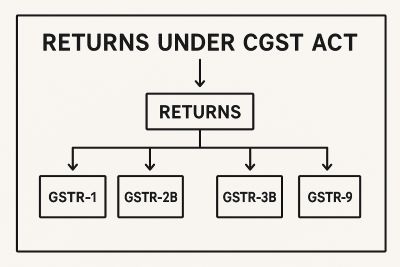

The Goods and Services Tax (GST) regime, implemented in India in 2017, introduced a paradigm shift in indirect taxation, aiming for a unified national market and streamlined compliance. Central to this regime is the mechanism of return filing, governed primarily by Sections 37 through 47 of the Central Goods and Services Tax (CGST) Act, 2017. This report provides an expert-level analysis of these provisions, detailing the procedures, requirements, and implications associated with furnishing various GST returns. It examines the evolution from initially proposed systems to the current framework, heavily reliant on automated data flow and system-driven checks. Key returns such as GSTR-1 (outward supplies), GSTR-3B (summary return and payment), and GSTR-9/9C (annual return and reconciliation) are analyzed in depth. The report highlights the critical role of Form GSTR-2B as the basis for Input Tax Credit (ITC) claims and the stringent conditions imposed under the revised Section 38, significantly impacting ITC eligibility based on supplier compliance. Furthermore, the report outlines the filing obligations for specific taxpayer categories, the procedures for first and final returns (Sections 40 and 45), and the substantial consequences of non-compliance, including late fees under Section 47 and interest under Section 50. Finally, it addresses the pervasive real-life challenges faced by businesses, particularly concerning data reconciliation and ITC mismatches, offering insights into the practical complexities of navigating the GST compliance landscape. The analysis underscores the increasing reliance on technology, the paramount importance of accurate and timely data reporting, and the significant compliance burden placed on taxpayers within this interconnected system.

Section 1: Furnishing Details of Outward Supplies (Section 37 – GSTR-1)

1.1 Overview, Applicability, and Frequency

Section 37 of the CGST Act, 2017, forms the bedrock of reporting outward supplies under the GST regime. It mandates every registered person, with specific exceptions, to furnish the details of their outward supplies of goods or services or both electronically.1 These details are crucial as they form the basis upon which the recipient of the supplies can claim Input Tax Credit (ITC).

Applicability: The requirement to file Form GSTR-1 extends to all normal and casual registered taxpayers who make outward supplies.2 Notably, certain categories of registered persons are exempt from filing GSTR-1, including Input Service Distributors (ISDs), Composition Scheme dealers, non-resident taxable persons (NRTPs), persons liable to deduct Tax at Source (TDS), persons liable to collect Tax at Source (TCS), and suppliers of Online Information and Database Access or Retrieval (OIDAR) services who pay tax themselves.1 It is imperative to note that filing GSTR-1 is mandatory even if no transactions occurred during a particular tax period; in such cases, a Nil Return must be filed.2

Frequency: The frequency of GSTR-1 filing depends on the taxpayer’s Aggregate Annual Turnover (AATO) in the preceding financial year:

- Monthly: Taxpayers with an AATO exceeding Rs. 5 crore are required to file GSTR-1 on a monthly basis.1

- Quarterly (QRMP Scheme): Taxpayers with an AATO up to Rs. 5 crore have the option to enroll in the Quarterly Return Monthly Payment (QRMP) scheme. If opted, they file GSTR-1 quarterly.1 Taxpayers under the QRMP scheme file both GSTR-1 and the summary return GSTR-3B on a quarterly basis.2 To facilitate ITC flow for their recipients, QRMP taxpayers can use the optional Invoice Furnishing Facility (IFF) to upload details of their Business-to-Business (B2B) supplies for the first two months of the quarter.3

The data furnished in GSTR-1 directly populates the recipient’s dynamic Form GSTR-2A and the static, auto-drafted statement Form GSTR-2B, making GSTR-1 the cornerstone of the ITC verification and matching mechanism within the GST Network (GSTN).4 This automated flow underscores the significance of accurate GSTR-1 filing.

1.2 Due Dates and Filing Procedure

Timely filing of GSTR-1 is crucial for maintaining compliance and ensuring the seamless flow of credit to recipients. The due dates are as follows:

- Monthly Filers: By the 11th day of the month succeeding the tax period.1

- Quarterly Filers (QRMP): By the 13th day of the month succeeding the end of the quarter.1

- Invoice Furnishing Facility (IFF – Optional for QRMP): By the 13th day of the month succeeding the month for which details are being furnished (applicable for the first two months of a quarter).3

Taxpayers can prepare and file GSTR-1 through various modes:

- Online data entry directly on the GST Portal.

- Using the offline utility tool provided by GSTN, where invoice data can be prepared offline and uploaded.

- Utilizing third-party application software provided by Application Software Providers (ASPs) through authorized GST Suvidha Providers (GSPs).2

A significant amendment to Section 37 introduced a time limit, restricting the filing of GSTR-1 for a tax period beyond three years from its original due date.1 This imposes a definitive cut-off for reporting past outward supplies.

1.3 Detailed Content Requirements (Analysis of Tables 1-15)

GSTR-1 demands a comprehensive disclosure of outward supply transactions, requiring invoice-level details for certain categories and summarized data for others. The form comprises multiple tables, each capturing specific information.1

GSTR-1: Key Table Contents and Significance

| Table No. | Description (Simplified) | Key Information Required | Significance for Compliance/ITC |

| 1, 2, 3 | Basic Details | GSTIN, Legal/Trade Name, Previous Year AATO | Identification & Context |

| 4 | B2B Supplies | Invoice-level details of taxable supplies to Registered Persons (incl. UIN), excluding zero-rated/deemed exports. | Crucial: Basis for recipient’s ITC claim in GSTR-2B. |

| 5 | B2C (Large) Inter-State | Invoice-level details of inter-state supplies to Unregistered Persons > Rs. 2.5 lakh invoice value. | Captures high-value inter-state B2C sales. |

| 6 | Zero-Rated & Deemed Exports | Invoice-level details of Exports, Supplies to SEZ (with/without payment), Deemed Exports. Shipping Bill details required (can be updated later).2 | Basis for export benefits/refunds. |

| 7 | B2C (Others) | State-wise summary of taxable supplies to Unregistered Persons (other than Table 5), net of debit/credit notes. | Consolidated reporting of smaller B2C sales. |

| 8 | Nil Rated, Exempt, Non-GST | Consolidated summary value of these outward supplies. | Disclosure of non-taxable/exempt supplies. |

| 9 | Amendments (B2B, B2C Large, Exports) | Amendments to details furnished in Tables 4, 5, 6 of previous tax periods. Includes current period Debit Notes, Credit Notes, Refund Vouchers related to these supplies. | Critical: Mechanism for correcting past errors/omissions. |

| 10 | Amendments (B2C Others) / Debit/Credit Notes (Unregistered) | Debit/Credit notes issued to Unregistered Persons; Amendments to Table 7 supplies of previous periods. | Correcting B2C supplies/reporting notes. |

| 11 | Advances Received/Adjusted | Details of advances received, advances adjusted against supplies, and amendments to previously reported advance information. | Accounting for tax liability on advances. |

| 12 | HSN-wise Summary | Summary of outward supplies categorized by HSN (goods) / SAC (services) codes. Reporting requirement (digits) depends on AATO. | Commodity/Service wise reporting for analysis. |

| 13 | Documents Issued | Summary of serial numbers of various documents issued during the tax period (invoices, notes, vouchers etc.). | Record of documents issued. |

| 14, 14A | Supplies via ECO (Supplier Reporting) | GSTIN-wise sales via ECOs where ECO collects TCS (u/s 52) or pays tax (u/s 9(5)). Table 14A for amendments. | Tracks e-commerce transactions for supplier. |

| 15, 15A | Supplies via ECO (ECO Reporting) | ECO reports supplier-wise sales (B2B & B2C) on which ECO pays tax (u/s 9(5)). Table 15A for amendments. | Tracks e-commerce transactions for ECO liability. |

The detailed nature of GSTR-1, especially for B2B transactions and amendments, necessitates meticulous record-keeping and accurate data entry.

1.4 Amendments, Rectifications, and Time Limits

The GST framework does not permit the revision of a return once filed.7 Errors or omissions discovered in a previously filed GSTR-1 must be rectified by reporting the correct details in the GSTR-1 of a subsequent tax period.2 This is typically done using the amendment tables (e.g., Table 9, 10, 14A, 15A).

A critical deadline governs these rectifications. Any correction or omission pertaining to the outward supplies of a financial year must be reported in the GSTR-1 filed for a period no later than the 30th day of November of the following financial year, or the date of furnishing the relevant Annual Return (GSTR-9), whichever is earlier.2 Failure to meet this deadline can result in the inability to correct reported figures and may impact the recipient’s ability to claim ITC related to amended invoices or notes.

While Form GSTR-1A was conceptualized to allow taxpayers to accept or reject auto-drafted details or add missed particulars after filing GSTR-1 but before GSTR-3B 11, its practical implementation and widespread use have been limited.

Certain limitations exist regarding amendments. For instance, when amending credit or debit notes, the recipient’s GSTIN generally cannot be changed. Similarly, while the original Place of Supply (POS) can be amended, a new POS cannot typically be added to a transaction.1 This underscores the need for accuracy in the initial filing.

Interestingly, judicial intervention has sometimes occurred. In specific cases, such as Star Engineers (I) Pvt. Ltd. 9, courts have permitted rectification of GSTR-1 beyond the prescribed timelines, particularly where genuine errors occurred (like reporting the ‘ship-to’ party’s GSTIN instead of the ‘bill-to’ party’s) and the tax liability had already been correctly discharged. This highlights a potential area of friction where procedural rigidity clashes with substantive compliance and taxpayer rights, although relying on such judicial relief is not a standard compliance strategy.

1.5 Interlinkages and Filing Restrictions

GSTR-1 is deeply integrated within the GST compliance ecosystem. Its data is fundamental for auto-populating liabilities in the summary return, GSTR-3B 12, and crucially, it feeds the recipient’s GSTR-2A and GSTR-2B, which determine ITC eligibility.4

Recognizing this interdependence, the GST Rules impose restrictions on GSTR-1 filing to enforce sequential compliance:

- Rule 59(6): A taxpayer is blocked from filing GSTR-1 (or using IFF) for a tax period if they have not filed their GSTR-3B for the preceding tax period(s). For monthly filers, this means the preceding month’s GSTR-3B must be filed; for quarterly (QRMP) filers, the preceding quarter’s GSTR-3B must be filed.4

- Rule 88C & 88D Intimations: If the system detects significant discrepancies between the liability declared in GSTR-1 and that paid in GSTR-3B (Rule 88C), or between ITC claimed in GSTR-3B and that available in GSTR-2B (Rule 88D), intimations (DRC-01B/DRC-01C) are issued. Failure to pay the differential amount or provide adequate reasons can lead to the blocking of subsequent GSTR-1 filing.4

- Rule 10A (Bank Account Details): Failure to furnish bank account details within the prescribed time (30 days from registration grant or before filing GSTR-1/IFF, whichever is earlier) results in the blocking of GSTR-1 filing.4

These restrictions demonstrate a clear trend towards increased automation and system-enforced compliance checks. GSTR-1 is no longer merely a declaration of sales but a critical input that triggers downstream processes and compliance checks. Errors or delays in GSTR-1 have immediate repercussions, not only for the filer’s own compliance cycle (due to potential blocking) but also directly impacting the recipient’s ability to claim ITC. This places immense pressure on businesses to ensure the timeliness and, more importantly, the accuracy of their GSTR-1 data. The detailed table requirements 1, strict amendment deadlines 2, and filing restrictions 4 collectively signify the high stakes involved. Accurate GSTR-1 filing by the supplier is directly linked to the recipient’s ITC flow and, consequently, their working capital management, establishing a clear causal relationship within the supply chain.5

Section 2: Furnishing Details of Inward Supplies (Section 38 – GSTR-2B & ITC)

2.1 Mechanism for Communicating Inward Supplies (GSTR-2B)

Section 38 of the CGST Act governs the communication of details related to inward supplies and the availability of Input Tax Credit (ITC). The original legislative intent behind Section 38 involved a dynamic, two-way communication process. It envisaged taxpayers filing Form GSTR-2, detailing their inward supplies, after verifying, validating, modifying, or deleting details auto-populated from their suppliers’ GSTR-1 filings (visible in Form GSTR-2A).18 This system aimed at real-time matching of invoices between suppliers and recipients.

However, due to complexities and challenges in implementation, the GSTR-2 and GSTR-3 (the originally intended summary return) system was never fully operationalized and was eventually kept in abeyance, rendering the original Section 38 and related forms like GSTR-2 effectively redundant.5

Recognizing the need for a stable mechanism for recipients to ascertain available ITC, the government introduced Form GSTR-2B and subsequently substituted Section 38 entirely via the Finance Act, 2022, effective from October 1, 2022.22 The revised Section 38 is titled ‘Communication of details of inward supplies and input tax credit’.19

Under the current mechanism mandated by the revised Section 38(1), the details of outward supplies furnished by suppliers (in their GSTR-1 or using the IFF) and the details of ITC are made available to the recipient electronically through an auto-generated, static statement – Form GSTR-2B.5 GSTR-2B is generated monthly (typically on the 14th of the month following the relevant month) and provides a fixed snapshot of the ITC available for a specific tax period, based on the GSTR-1/IFF filed by suppliers by their respective due dates.12 A key feature of GSTR-2B is that it clearly demarcates ITC as ‘Available’ or ‘Not Available’ based on various criteria.5

2.2 Role of GSTR-2B in Input Tax Credit (ITC) Claims

Form GSTR-2B has fundamentally changed the landscape of ITC claims. It serves as the primary and authoritative document for determining the eligible ITC that a taxpayer can claim in their summary return, Form GSTR-3B.10 Taxpayers are expected, and system checks often enforce, that the ITC claimed in Table 4 of GSTR-3B aligns with the ‘ITC Available’ figures reflected in the corresponding GSTR-2B.12

This shift marked the definitive end of the provisional ITC concept. Previously, under Rule 36(4) of the CGST Rules, taxpayers were allowed to claim a certain percentage (initially 20%, then 10%, then 5%) of the matched ITC as provisional credit for invoices that were present in their purchase records but not yet reflected in their GSTR-2A.24 This provision was intended as a temporary relief for mismatches due to supplier delays. However, effective January 1, 2022, Rule 36(4) was amended to remove this allowance entirely.22 Since then, ITC can be claimed only if and to the extent it appears in the taxpayer’s GSTR-2B.24

This strict linkage is reinforced by Section 16(2)(aa) of the CGST Act, which was introduced as a condition for claiming ITC. It explicitly states that credit on an invoice or debit note can be availed only when the details of such invoice/debit note have been furnished by the supplier in their statement of outward supplies (GSTR-1/IFF) and these details have been communicated to the recipient in the manner specified under Section 38 (i.e., through GSTR-2B).

2.3 Conditions Restricting ITC under Section 38(2)(b)

The revised Section 38(2) goes beyond simply communicating available ITC. Clause (b) of Section 38(2) introduces a new layer of restrictions, specifying circumstances under which ITC shall not be availed by the recipient, irrespective of whether the corresponding supply details appear in GSTR-2B.5 These restrictions are based on the compliance status and behavior of the supplier.

The law empowers the government to restrict ITC on inward supplies received from suppliers who:

- Are newly registered, for a specified period after their registration.5

- Have defaulted in payment of taxes, and such default persists for a specified period.5

- Have reported output tax payable in GSTR-1 exceeding the tax paid via GSTR-3B beyond a specified limit for a given period.5

- Have availed ITC in their GSTR-3B in excess of the credit available to them in their GSTR-2B beyond a specified limit.5

- Have defaulted in discharging their tax liability according to the provisions of Section 49(12), which relates to prescribed limits on the utilization of the electronic credit ledger for tax payment.5

- Fall under any other class of persons as may be prescribed by the government.5

Conditions Leading to ITC Ineligibility under Section 38(2)(b)

| Condition | Description | Status (Prescribed limits/period notified?) | Implication for Recipient |

| Newly Registered Supplier | ITC restricted on supplies from supplier within a certain period post-registration. | No (as per available sources) 19 | Potential ITC denial on supplies from new vendors. |

| Supplier Default in Tax Payment | ITC restricted if supplier fails to pay tax for a certain period. | No (as per available sources) 19 | ITC risk if supplier defaults on payments. |

| Supplier GSTR-1 Liability > GSTR-3B Tax Paid | ITC restricted if supplier’s declared liability exceeds tax paid beyond a certain limit. | No (as per available sources) 19 | ITC risk based on supplier’s GSTR-1 vs GSTR-3B reconciliation. |

| Supplier Claimed Excess ITC | ITC restricted if supplier claims ITC in GSTR-3B exceeding their GSTR-2B beyond a certain limit. | No (as per available sources) 19 | ITC risk based on supplier’s own ITC compliance. |

| Supplier Default under Sec 49(12) | ITC restricted if supplier violates rules regarding payment via credit ledger. | No (as per available sources) 19 | ITC risk linked to supplier’s mode of tax payment. |

| Other Prescribed Class of Persons | ITC restricted on supplies from suppliers belonging to a category notified by the government. | No (as per available sources) 19 | Potential future restrictions based on government notification. |

A critical aspect of these restrictions is the recurring use of the term “prescribed”. As indicated in the table and supported by sources 5, the specific time periods, monetary limits, or classes of persons relevant to these conditions were largely yet to be notified by the government at the time the source materials were updated. This lack of specific notification creates significant uncertainty for businesses, making it difficult to definitively assess the risk associated with ITC from certain suppliers. Until these parameters are prescribed, the full impact of Section 38(2)(b) remains partially ambiguous, complicating risk management and compliance planning.

2.4 Recipient’s Responsibilities: Verification and Reconciliation

Given the reliance on GSTR-2B and the potential restrictions under Section 38(2)(b), the recipient’s role in verification and reconciliation becomes paramount. Businesses must:

- Perform Mandatory Reconciliation: Regularly and diligently reconcile their purchase records (purchase register, books of accounts) with the data auto-populated in Form GSTR-2B before filing their GSTR-3B.10

- Investigate Discrepancies: Identify the root causes of any mismatches found during reconciliation. These could range from simple data entry errors, timing differences in recording invoices, to more serious issues like the supplier failing to file GSTR-1, filing incorrect details (wrong GSTIN, amount, POS), or potential supplier non-compliance triggering Section 38(2)(b) restrictions.10

- Communicate with Suppliers: Proactively communicate with suppliers to rectify errors in their GSTR-1 filings that are causing mismatches or affecting ITC availability in GSTR-2B.10

- Claim Correct ITC: Ensure that the ITC claimed in GSTR-3B corresponds only to the ‘Available’ credit shown in GSTR-2B and pertains to genuine, eligible inward supplies used for business purposes, excluding any blocked credits under Section 17(5) or credits related to personal expenses.12

The introduction of Section 38 and the GSTR-2B mechanism fundamentally transfers a significant portion of the compliance burden onto the recipient. The recipient’s ability to claim ITC is no longer just dependent on possessing a valid invoice and proof of payment but is now directly contingent on the supplier’s real-time filing accuracy and overall tax compliance status.5 The removal of provisional ITC 24 further solidifies this, leaving the recipient with little buffer against supplier defaults or errors. This necessitates a shift towards more proactive and robust vendor management strategies. Businesses need to implement thorough due diligence during vendor onboarding, assessing their compliance history, and continuously monitor supplier filing performance.19 Regular communication and follow-up regarding GSTR-2B discrepancies become essential operational activities to mitigate the risk of ITC denial and potential working capital strain.10

From a systemic perspective, the stringent conditions in Section 38, coupled with the automated GSTR-2B statement, represent a deliberate effort by the government to combat ITC fraud, particularly through fake invoicing schemes.19 By linking the recipient’s ITC claim to the supplier’s compliance behavior (including tax payment history), the system aims to create checks and balances that make it harder for fraudulent entities to pass on fictitious credits.5 This approach uses recipient-side controls (via GSTR-2B and Section 38 limitations) to indirectly enforce supplier-side compliance and protect government revenue.

Section 3: Furnishing of Monthly/Quarterly Return (Section 39(1) – GSTR-3B)

3.1 Purpose, Legal Status, and Applicability

Section 39(1) of the CGST Act mandates the furnishing of a return, electronically, for every tax period by registered persons. Form GSTR-3B serves as this primary return for most taxpayers.7 Its core purpose is to enable taxpayers to declare a summary of their outward supplies, inward supplies liable to reverse charge, eligible Input Tax Credit (ITC), and to discharge their net GST liability for the tax period.13

Applicability: GSTR-3B filing is mandatory for all persons registered under GST as normal taxpayers or casual taxpayers.13 However, certain categories are exempt from filing GSTR-3B and have different return requirements, including Input Service Distributors (ISDs), non-resident taxable persons (NRTPs), taxpayers under the Composition Scheme, persons deducting TDS (Section 51), persons collecting TCS (Section 52), and OIDAR service providers.29

Legal Status: The journey of GSTR-3B to becoming the recognized return under Section 39(1) was contentious. Initially introduced in July 2017 as a temporary, simplified return (a “stop-gap arrangement”) due to the deferment of the more complex GSTR-2 and GSTR-3 forms 23, its legal standing as the statutory ‘return’ under Section 39 was questioned. Some High Courts, like the Gujarat HC in the AAP & Co. case, initially ruled that GSTR-3B was not the return envisaged under Section 39, which had implications for ITC claim deadlines linked to Section 16(4).23 However, practical necessities prevailed. Rule 61 of the CGST Rules was retrospectively amended to explicitly state that the return specified under Section 39(1) shall be furnished in Form GSTR-3B.30 Furthermore, the Supreme Court, in the Bharti Airtel case, acknowledged GSTR-3B as a valid return under the GST framework, emphasizing its finality and non-revisable nature upon submission.7 Thus, despite its origins, GSTR-3B is now functionally and legally accepted as the primary summary return under Section 39(1) for regular taxpayers.

3.2 Filing Frequency and Due Dates

The filing frequency for GSTR-3B depends on the taxpayer’s AATO and chosen scheme:

- Monthly: Taxpayers with an AATO exceeding Rs. 5 crore in the preceding financial year must file GSTR-3B monthly. The due date is the 20th day of the month following the tax period.3

- Quarterly (QRMP Scheme): Taxpayers with an AATO of up to Rs. 5 crore can opt for the QRMP scheme, allowing them to file GSTR-3B quarterly.13 The due dates for quarterly GSTR-3B are staggered based on the taxpayer’s principal place of business:

- 22nd day of the month following the quarter: For states like Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, Daman & Diu, Dadra & Nagar Haveli, Puducherry, Andaman & Nicobar Islands, Lakshadweep.3

- 24th day of the month following the quarter: For states like Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, Odisha, Jammu & Kashmir, Ladakh, Chandigarh, Delhi.3

- Monthly Payment for QRMP: It’s crucial to note that taxpayers under the QRMP scheme, despite filing GSTR-3B quarterly, are still required to pay their tax liability monthly for the first two months of the quarter using Form GST PMT-06, by the 25th day of the following month.32 The tax paid via PMT-06 is then adjusted when filing the quarterly GSTR-3B.

3.3 Content and Structure (Summary Data, ITC, Payment)

GSTR-3B is fundamentally a summary return; it does not require the submission of invoice-level details.13 It consolidates the taxpayer’s activities for the tax period into specific tables.

GSTR-3B: Key Tables and Information Type

| Table No. | Description | Type of Data | Key Information Captured | Auto-populated Source (if any, based on ) |

| 3.1 | Outward Supplies & Inward Supplies liable to Reverse Charge | Summary/Consolidated | Taxable value & Tax (IGST, CGST, SGST/UTGST, Cess) for various supply types. | GSTR-1/IFF, GSTR-2B (for RCM inward) |

| 3.1.1 | Supplies notified u/s 9(5) (ECO related) | Summary/Consolidated | Taxable value & Tax for supplies via ECO where ECO pays tax. | GSTR-1/IFF (Tables 14, 15) |

| 3.2 | Inter-State Supplies to Unregistered, Composition, UIN Holders | Summary/Consolidated | Place of Supply, Taxable Value, IGST amount for these specific inter-state supplies. | GSTR-1/IFF |

| 4 | Eligible ITC | Summary/Consolidated | ITC Available (Imports, RCM, ISD, Other), ITC Reversed, Net ITC Available, Ineligible ITC. | GSTR-2B |

| 5 | Exempt, Nil-rated & Non-GST inward supplies | Summary/Consolidated | Value of such inward supplies (Inter-state & Intra-state). | Likely manual entry based on books. |

| 5.1 | Interest and Late Fee | Summary/Consolidated | Interest & Late Fee payable under different tax heads. | System Calculated (editable) 33 |

| 6 | Payment of Tax | Summary/Consolidated | Tax payable, Tax paid through ITC, Tax paid through Cash, Interest/Late Fee paid. | Calculated based on Tables 3.1, 4, 5.1. |

Table 4 (Eligible ITC) and Table 6 (Payment of Tax) are particularly critical as they determine the net tax liability and its discharge through the electronic credit and cash ledgers.

3.4 Auto-population Mechanism and Linkages

In recent years, the GSTN has significantly enhanced the auto-population features of GSTR-3B to improve accuracy and ease of filing.12

- Liability Tables (3.1, 3.1.1, 3.2): These are largely auto-populated based on the details filed by the taxpayer in their Form GSTR-1 or using the IFF.12

- ITC Table (Table 4): This crucial table is auto-populated with figures derived from the taxpayer’s Form GSTR-2B, reflecting eligible and ineligible credits based on supplier filings.12

- Interest & Late Fee (Table 5.1): The system often calculates and auto-populates these figures based on the filing date of the current return and data from previous returns.13

- Editability: While the system provides these auto-populated figures, taxpayers generally retain the ability to edit them. However, significant deviations, particularly downward revisions in liability (Table 3.1) or upward revisions in claimed ITC (Table 4A), may trigger system warnings or flags, potentially inviting scrutiny.12 Taxpayers are expected to ensure the final figures declared are accurate as per their records and the governing provisions.

The increasing reliance on auto-population reinforces the ‘upstream’ accuracy principle – errors in GSTR-1 or mismatches between GSTR-2B and purchase records need to be resolved before filing GSTR-3B, as the system nudges taxpayers towards accepting the auto-generated data.

3.5 Nil Return Filing Requirements

Even if a registered taxpayer has no business activity (no outward supplies, no inward supplies liable to reverse charge, no ITC to claim) during a tax period, filing a Nil GSTR-3B is mandatory.7 Failure to file a Nil return attracts the same consequences (late fees, interest if applicable later) as non-filing of a regular return. The GST portal provides simplified options for filing Nil GSTR-3B, including filing via SMS.13

The evolution of GSTR-3B from a temporary fix to the cornerstone of monthly/quarterly compliance reflects a pragmatic adaptation by the GST administration to overcome initial system limitations.7 This pragmatism, however, came at the cost of initial legal ambiguity and litigation concerning its status and impact on deadlines.23 The current framework, with heavy auto-population from GSTR-1 and GSTR-2B 12, strongly encourages taxpayers to rely on system-generated data, thereby emphasizing the critical need for accuracy in the source returns (GSTR-1) and thorough reconciliation with GSTR-2B before finalizing GSTR-3B. Furthermore, the blocking of GSTR-1 filing for pending GSTR-3B 4 positions GSTR-3B (and the associated tax payment) as a crucial control point in the compliance chain, ensuring that taxpayers settle their liabilities before being allowed to report further supplies.

Section 4: Filing of Return by Other Categories of Persons

Beyond the regular taxpayers filing GSTR-1 and GSTR-3B, the CGST Act prescribes specific return filing obligations for various other categories of registered persons, tailored to their unique roles and functions within the GST ecosystem.

4.1 Composition Levy Taxpayers (Section 10)

Taxpayers opting for the Composition Scheme under Section 10, designed for small businesses with turnover below specified thresholds (currently Rs. 1.5 crore for goods suppliers, with specific provisions for service providers) 34, have a simplified compliance structure:

- Form CMP-08: Instead of monthly tax payments via GSTR-3B, composition taxpayers make quarterly payments of self-assessed tax using a statement-cum-challan, Form CMP-08. This is due by the 18th day of the month succeeding the quarter.3 CMP-08 requires reporting summary details of outward supplies, inward supplies attracting reverse charge, and tax payable.37 Since CMP-08 is classified as a statement, not a return, late fees under Section 47 are not applicable for delayed filing, although interest under Section 50 is levied on delayed tax payment.37

- Form GSTR-4: Composition taxpayers file an annual return in Form GSTR-4. The due date for GSTR-4 is the 30th day of June following the end of the financial year (this was extended from 30th April effective FY 2024-25 onwards).3 GSTR-4 consolidates the information reported in the quarterly CMP-08 statements and requires details of inward supplies received (including purchases from registered/unregistered dealers and imports), summary of outward supplies, and tax paid.34 Filing GSTR-4 is mandatory for anyone registered under the composition scheme during any part of the financial year, even if all CMP-08s were filed as Nil (provided other conditions for Nil filing are met).34

4.2 Non-Resident Taxable Persons (NRTP – Section 27)

NRTPs are individuals or businesses without a fixed establishment in India who temporarily conduct transactions involving taxable supplies in the country.41 They have specific registration and return filing requirements:

- Form GSTR-5: NRTPs must file a monthly return in Form GSTR-5. This return details their outward supplies made within India, inward supplies received (including imports), amendments to previous returns, tax liability calculation, tax paid, and any refund claimed from the electronic cash ledger.3

- Due Date: The statutory due date for GSTR-5 is typically the 13th day of the month following the tax period (this was amended from the 20th by the Finance Act, 2022, though implementation via notification may vary or be subject to extensions).3 For the final month of their registration validity, the return must be filed within 7 days after the expiry of registration.41

- ITC Restriction: NRTPs generally cannot claim ITC on their inward supplies, except for the tax paid on goods imported by them.42 However, the tax paid by the NRTP on their outward supplies is available as credit to their registered recipients in India.42

4.3 Non-Resident OIDAR Service Providers

Entities located outside India providing Online Information and Database Access or Retrieval (OIDAR) services to non-taxable online recipients (e.g., B2C customers) in India have a distinct return requirement:

- Form GSTR-5A: These providers must file Form GSTR-5A monthly.3

- Due Date: The due date for GSTR-5A is the 20th day of the month following the tax period.3

4.4 Input Service Distributors (ISD – Section 20)

An ISD is typically a head office or corporate office that receives invoices for input services used by multiple units or branches (often with different GSTINs under the same PAN) and distributes the corresponding ITC to those units.46

- Form GSTR-6: Every ISD is required to file a monthly return in Form GSTR-6.3 Filing is mandatory each month, even if there is no ITC to distribute (Nil return).46

- Due Date: The due date for GSTR-6 is the 13th day of the month following the tax period.3 Extensions may be granted.50

- Content: GSTR-6 contains details of the ITC received by the ISD (auto-populated from supplier GSTR-1s into a read-only Form GSTR-6A for verification 46), details of eligible and ineligible ITC, and crucially, the manner and details of ITC distributed to recipient units through ISD invoices.46 It also includes tables for reporting amendments to previously furnished information and any mismatches or reclamations of credit.46

4.5 TDS Deductors (Section 51)

Certain entities are mandated under Section 51 to deduct Tax at Source (TDS) when making payments to suppliers for contractual supplies exceeding Rs. 2.5 lakh. These deductors typically include government departments, local authorities, governmental agencies, and other notified entities.51

- Form GSTR-7: TDS deductors must file a monthly return in Form GSTR-7.3

- Due Date: The due date for GSTR-7 is the 10th day of the month following the month in which TDS was deducted.3

- Content: GSTR-7 contains details of the TDS deducted (including the GSTIN of the deductee), the amount of TDS paid to the government, any TDS payable, and details of any TDS refund claimed.51

- Information Flow: The details furnished in GSTR-7 are auto-populated into the deductee’s (supplier’s) electronic liability register and also appear in their GSTR-2A (Part C) and the ‘TDS and TCS Credit Received’ statement on the GST portal.51 The deductee must accept these details online to get the credit transferred to their electronic cash ledger.54 Based on the filed GSTR-7, a TDS certificate (Form GSTR-7A) is made available to the deductee.51

- Mandatory Filing: As per recommendations from the 53rd GST Council meeting (pending formal notification), GSTR-7 filing is intended to be mandatory every month, irrespective of whether any tax was deducted during that month.51

4.6 TCS Collectors (Section 52)

E-commerce operators (ECOs) who facilitate supplies of goods or services made by other suppliers through their platform are required under Section 52 to collect Tax at Source (TCS) on the net value of taxable supplies made through them by those suppliers.54

- Form GSTR-8: ECOs liable to collect TCS must file a monthly statement in Form GSTR-8.3

- Due Date: The due date for GSTR-8 is the 10th day of the month following the month in which TCS was collected.3

- Content: GSTR-8 contains details of the outward supplies of goods/services made by suppliers through the ECO platform and the amount of TCS collected on these supplies.3

- Information Flow: Similar to TDS, the details furnished by the ECO in GSTR-8 are made available to the concerned supplier in their ‘TDS and TCS Credit Received’ statement on the GST portal. The supplier needs to accept these details to get the TCS amount credited to their electronic cash ledger.54

The existence of these distinct return forms (GSTR-4, GSTR-5, GSTR-5A, GSTR-6, GSTR-7, GSTR-8) alongside the primary GSTR-1/GSTR-3B framework illustrates a targeted compliance strategy within the CGST Act. Instead of a one-size-fits-all approach, the reporting requirements are tailored to the specific nature and function of different taxpayer categories – simplifying compliance for small businesses under composition, addressing the unique circumstances of non-residents, facilitating internal credit distribution for ISDs, and enabling tax deduction/collection at source mechanisms. Furthermore, returns like GSTR-7 (TDS) and GSTR-8 (TCS) function significantly as information returns. They capture transaction details from a third party (deductor/collector) and feed this data into the system for verification and action by the actual supplier/recipient.51 This reinforces the role of the GSTN as an information-matching platform, using data triangulation to enhance compliance and transparency across different transaction types.

Section 5: Annual Return (Section 44 – GSTR-9)

5.1 Purpose, Applicability, and Exemptions

Section 44 of the CGST Act mandates the filing of an Annual Return, designated as Form GSTR-9. The primary purpose of GSTR-9 is to provide a consolidated summary of the taxpayer’s GST transactions and activities throughout a financial year. It aggregates the information furnished in the monthly or quarterly returns (GSTR-1 and GSTR-3B) filed during that year, covering details of outward supplies, inward supplies, Input Tax Credit (ITC) availed and reversed, taxes paid, refunds claimed, demands raised, and HSN-wise summaries of supplies.56 This comprehensive declaration facilitates reconciliation and provides tax authorities with a complete overview of the taxpayer’s annual GST compliance.

Applicability: Filing GSTR-9 is mandatory for every person registered under GST as a normal taxpayer, including SEZ units and SEZ developers.56

Exemptions and Optional Filing:

- Specific Exclusions: Certain categories of registered persons are explicitly excluded from the requirement to file GSTR-9. These include Input Service Distributors (ISDs), persons paying TDS under Section 51, persons collecting TCS under Section 52, Casual Taxable Persons, and Non-Resident Taxable Persons (NRTPs).56

- Composition Taxpayers: Taxpayers under the Composition Scheme are required to file a separate annual return, Form GSTR-9A. However, the requirement to file GSTR-9A has often been waived or made optional for several financial years.57

- Turnover-Based Option: A significant relaxation exists based on turnover. For taxpayers whose Aggregate Annual Turnover (AATO) during the financial year is up to Rs. 2 crore, the filing of GSTR-9 has been made optional. This relaxation has been consistently provided for financial years from 2017-18 up to 2023-24.57 Taxpayers with AATO exceeding Rs. 2 crore must mandatorily file GSTR-9.

- Government Departments/Local Authorities: Departments of the Central or State Government or local authorities whose books are audited by the Comptroller and Auditor-General of India (C&AG) or an auditor appointed for local authorities under specific laws are also exempt from filing GSTR-9.56

5.2 Due Date and Filing Requirements

The statutory due date for filing the GSTR-9 Annual Return for a financial year is the 31st day of December of the subsequent calendar year.3 For example, the GSTR-9 for FY 2024-25 is due by December 31, 2025. The government may extend this due date through notifications, as has happened in previous years.56

Prerequisites: A critical prerequisite for filing GSTR-9 is that the taxpayer must have filed all applicable Form GSTR-1/IFF and Form GSTR-3B returns for the relevant financial year.60 Without completing the periodic filings, the annual return cannot be submitted.

Nil Return: A taxpayer can file a Nil GSTR-9 if they meet a stringent set of conditions for the entire financial year, including: no outward supplies, no receipt of goods/services, no other liability, no ITC claimed, no refund claimed, no demand orders received, and no late fees payable.59

5.3 Analysis of Key Sections and Tables (Parts I-VI)

Form GSTR-9 is structured into six parts and nineteen tables, designed to capture a comprehensive annual picture of GST activities.57 Many tables are auto-populated based on the data from the taxpayer’s filed GSTR-1 and GSTR-3B returns for the year, although several fields remain editable.59

- Part I (Tables 1, 2, 3): Basic Details – Captures GSTIN, legal name, trade name, and the relevant financial year. Auto-populated.

- Part II (Tables 4, 5): Details of Outward Supplies – Requires reporting the summary of outward supplies made during the financial year, categorized into supplies on which tax is payable (Table 4) and supplies on which tax is not payable (Table 5 – includes zero-rated without payment, exempt, nil-rated, non-GST supplies). These tables are auto-populated based on GSTR-1 filings but are editable to allow reconciliation with books of accounts.58

- Part III (Tables 6, 7, 8): Details of ITC – This part deals with Input Tax Credit for the financial year.

- Table 6: Details of ITC availed as declared in Form GSTR-3B returns filed during the year. Table 6A (Total ITC availed via GSTR-3B) is auto-populated and non-editable.59 Requires bifurcation of availed ITC into Inputs, Input Services, and Capital Goods, although reporting consolidated figures under ‘Inputs’ is often permitted as a relaxation.62 Also includes ITC from RCM, imports, and ISDs.

- Table 7: Details of ITC reversed and ineligible ITC for the financial year as per various rules (e.g., Rule 37, 39, 42, 43) and Section 17(5). Reporting consolidated figures under ‘Other Reversal’ (Table 7H) for certain categories is often allowed as a relaxation, except for TRAN-I/II reversals which must be shown separately.62

- Table 8: Other ITC-related information. This includes the crucial reconciliation of ITC as per GSTR-2A (Table 8A – auto-populated from GSTR-2A and non-editable 59) with ITC availed in GSTR-3B (Table 6B+6H). It also captures ITC available but not availed, and ITC lapsed.

- Part IV (Table 9): Details of Tax Paid – Reports the tax paid (IGST, CGST, SGST/UTGST, Cess, Interest, Late Fee, Penalty, Others) as declared in the GSTR-3B returns filed during the year. This table is largely auto-populated based on GSTR-3B data. The ‘Tax Payable’ column is editable, but the ‘Paid through Cash’ and ‘Paid through ITC’ columns are non-editable.59

- Part V (Tables 10, 11, 12, 13, 14): Transactions Pertaining to Previous FY Reported in Current FY – This part captures details of transactions (supplies, amendments, ITC reversals/availment) related to the previous financial year but declared in the returns (GSTR-1/GSTR-3B) of the current financial year, specifically between April and the specified date (typically 30th November or Annual Return filing date) of the current year.58 Table 14 reports the differential tax paid on account of declarations in Tables 10 and 11. Tables 12 (Reversal of previous year ITC in current year) and 13 (ITC for previous year availed in current year) are often made optional.62

- Part VI (Tables 15, 16, 17, 18, 19): Other Information – Includes details of refunds claimed, sanctioned, rejected, pending (Table 15 – often optional 62); demands of taxes (Table 15 – often optional); supplies received from Composition taxpayers, deemed supplies under job work, goods sent on approval (Table 16 – often optional); HSN-wise summary of outward supplies (Table 17 – mandatory, level of detail depends on turnover 63); HSN-wise summary of inward supplies (Table 18 – often optional 62); and late fees payable and paid (Table 19).

Payment of Additional Liability: If, during the preparation of GSTR-9, the taxpayer discovers any additional tax liability that was not declared or paid through GSTR-3B, they can declare this liability in Table 9 (‘Tax Payable’) and pay it voluntarily using Form GST DRC-03. This payment must be made using the electronic cash ledger only.59

5.4 Optional Fields and Relaxations (FY-specific)

Recognizing the complexity and compliance burden associated with GSTR-9, the government has consistently provided relaxations by making several tables or fields within tables optional for various financial years (including FY 2017-18 through FY 2022-23, with similar trends expected for FY 2023-24).62

GSTR-9: Summary of Key Optional vs. Mandatory Tables/Fields (Illustrative for recent FYs)

| Part | Table No. | Description | Status (Generally Optional/Relaxed) | Relaxation Details |

| II | 4B-4E, 5A-5F | Outward Supplies (Taxable & Non-Taxable) | Partially Optional | Option to report net of credit/debit notes and amendments, instead of reporting notes/amendments separately in 4I-4L / 5H-5K.62 |

| II | 5D, 5E, 5F | Exempt, Nil Rated, Non-GST Supplies | Partially Optional | Option to report consolidated figure for Exempted & Nil Rated under ‘Exempted’ (5D). Non-GST (5F) to be shown separately (FY 22-23 onwards).62 |

| III | 6B, 6C, 6D, 6E | ITC Breakup (Inputs, Services, Capital Goods, RCM) | Partially Optional | Option to report consolidated ITC (Inputs/Input Services/Capital Goods) under ‘Inputs’ (6B). Option to report consolidated RCM ITC (Registered/Unregistered) under 6D.62 |

| III | 7A-7E | ITC Reversal Breakup (Rules 37, 39, 42, 43 etc.) | Partially Optional | Option to report consolidated reversals (except TRAN reversals) under ‘Other Reversal’ (7H).62 |

| V | 12, 13 | Previous FY ITC Reversal/Availment in Current FY | Optional | Option not to fill these tables.62 |

| VI | 15 | Refunds and Demands | Optional | Option not to fill Tables 15A-15G.62 |

| VI | 16 | Supplies from Composition/Deemed Supply/Approval Basis | Optional | Option not to fill Tables 16A, 16B.63 |

| VI | 18 | HSN-wise Summary of Inward Supplies | Optional | Option not to fill this table.62 |

(Note: Taxpayers should always refer to the specific instructions issued for the relevant financial year before filing.)

The introduction of these optional fields and the turnover threshold for mandatory filing reflects the practical challenges taxpayers, especially smaller ones, faced in compiling and reconciling the extensive data required by the original GSTR-9 format.57 This represents a balancing act between the authorities’ need for comprehensive annual data for verification and the compliance capacity of the taxpayer base. Despite the relaxations, GSTR-9 remains a crucial compliance document. It serves as a vital self-assessment and correction mechanism, allowing taxpayers a final opportunity to declare and pay any short-paid liability for the financial year through DRC-03, potentially mitigating future disputes.59 Furthermore, the consolidated data filed in GSTR-9, even with optional fields, provides a critical dataset for tax authorities. It enables them to perform macro-level reconciliations (e.g., comparing annual figures with the sum of periodic returns) and identify potential discrepancies or high-risk cases for further scrutiny or audit.10

Section 6: Reconciliation Statement (Section 44 – GSTR-9C)

6.1 Purpose, Applicability, and Threshold

Form GSTR-9C is intrinsically linked to the GSTR-9 Annual Return. Mandated under Section 44 of the CGST Act and detailed in Rule 80 of the CGST Rules, GSTR-9C serves as a reconciliation statement. Its primary purpose is to reconcile the figures reported in the taxpayer’s GSTR-9 Annual Return for a financial year with the corresponding figures contained in their audited annual financial statements.56 It requires a detailed comparison of turnover, taxes paid, and Input Tax Credit (ITC) availed, highlighting any differences and requiring explanations for the same.

Applicability: The requirement to file GSTR-9C is triggered by the taxpayer’s Aggregate Annual Turnover (AATO). It is mandatory for every registered person whose AATO during the relevant financial year exceeds Rs. 5 crore.61 It is important to note that this threshold was initially set at Rs. 2 crore but was subsequently raised to Rs. 5 crore for FY 2018-19 and onwards.61 Taxpayers with turnover up to Rs. 5 crore are not required to file GSTR-9C.

Linkage with GSTR-9: GSTR-9C is not a standalone return; it must be filed along with the GSTR-9 Annual Return.68 If GSTR-9C is applicable to a taxpayer, the filing of the annual return under Section 44 is considered complete only when both Form GSTR-9 and Form GSTR-9C have been furnished. Filing only GSTR-9 in such cases constitutes an incomplete return.68

6.2 Due Date and Self-Certification Requirement

Due Date: The due date for filing Form GSTR-9C coincides with the due date for filing the GSTR-9 Annual Return, which is the 31st day of December following the end of the relevant financial year.71

Certification Requirement: A significant change occurred regarding the certification of GSTR-9C. Initially, the form required certification by a practicing Chartered Accountant (CA) or Cost Accountant (CMA), effectively making it an audit report under GST law.68 However, the Finance Act, 2021, amended Section 35 (removing the requirement for mandatory GST audit) and Section 44 of the CGST Act. Consequently, from FY 2020-21 onwards, Form GSTR-9C requires self-certification by the taxpayer themselves.56 While taxpayers may still engage professionals to prepare the reconciliation statement, the statutory responsibility for its accuracy now rests solely with the taxpayer.

6.3 Analysis of Key Reconciliation Areas (Parts A & B)

Form GSTR-9C is divided into two main parts: Part A (Reconciliation Statement) and Part B (Certification, now self-certification).69

Part A – Reconciliation Statement: This part contains the core reconciliation exercise.

- Part I: Basic Details (Tables 1-4): Captures Financial Year, GSTIN, Legal Name, Trade Name, and requires the taxpayer to state if they are liable to be audited under any other Act.69

- Part II: Reconciliation of Turnover (Tables 5-8): This is a critical section comparing the gross and taxable turnover reported in the audited financial statements with the turnover declared in the GSTR-9 annual return.

- Table 5: Reconciles Gross Turnover. It starts with the turnover as per audited financial statements (at PAN level, requiring extraction for the specific GSTIN 70) and provides fields for various adjustments (e.g., unbilled revenue, unadjusted advances, deemed supplies, credit notes issued after year-end but reflected in financials, trade discounts) to arrive at the turnover as per GSTR-9.69 Many adjustment fields (Table 5B to 5N) have been made optional, allowing taxpayers to report the net effect in Table 5O.65

- Table 6: Requires reasons for any unreconciled difference in gross turnover identified in Table 5P.69

- Table 7: Reconciles Taxable Turnover. It derives the taxable turnover from the reconciled gross turnover (from Table 5Q) by deducting exempt, nil-rated, non-GST, and reverse charge supplies, comparing it with the taxable turnover declared in GSTR-9.69

- Table 8: Requires reasons for any unreconciled difference in taxable turnover identified in Table 7G.69

- Part III: Reconciliation of Tax Paid (Tables 9-11): This section reconciles the tax liability and tax paid.

- Table 9: Compares the rate-wise tax liability (IGST, CGST, SGST/UTGST, Cess) based on the reconciled taxable turnover (from Part II) with the tax liability declared and paid as per GSTR-9.69

- Table 10: Requires reasons for any unreconciled difference in tax paid identified in Table 9R.69

- Table 11: Reports any additional tax liability arising due to the reconciliation exercise in Part II (Turnover) or Part III (Tax Paid), which needs to be paid via DRC-03.69

- Part IV: Reconciliation of Input Tax Credit (Tables 12-16): Focuses on reconciling ITC figures.

- Table 12: Reconciles the Net ITC availed as per GSTR-9 (Table 7J) with the ITC availed as per audited financial statements or books of account.69 Tables 12B (Prior FY ITC claimed in current FY) and 12C (Current FY ITC to be claimed in next FY) are often optional.72

- Table 13: Requires reasons for any unreconciled difference in ITC identified in Table 12F.69

- Table 14: Provides for reconciliation of ITC availed on various categories of expenses (as per audited financials/books) with the total ITC availed as per GSTR-9. This table has been made optional for several financial years.63

- Table 15: Requires reasons for unreconciled differences between expense-wise ITC (Table 14R) and total availed ITC (Table 14S).69 (Linked to optional Table 14).

- Table 16: Reports any additional ITC reversal liability arising due to the reconciliation in Part IV, payable via DRC-03.69

- Part V: Auditor’s Recommendation on Additional Liability (Conceptually Integrated): Although originally designed for auditor recommendations, this part effectively represents the taxpayer’s self-declared additional liability arising from the entire reconciliation process (combining Tables 11 and 16), which must be paid via DRC-03 using cash.65

Part B – Certification: This section, previously requiring certification by a CA/CMA, now involves self-certification by the taxpayer, affirming the accuracy of the information provided in Part A and the reconciliation performed.56

GSTR-9C: Key Reconciliation Points and Tables

| Part | Table(s) | Reconciliation Area | Key Figures Compared | Common Reasons for Difference | Optionality Status (Recent FYs) |

| A-II | 5, 6 | Gross Turnover | Audited Financials Turnover vs. GSTR-9 Turnover | PAN vs GSTIN figures, Unbilled Revenue, Advances, Deemed Supplies, Post-year end CNs/DNs, Trade Discounts, Different Accounting Standards vs GST Valuation. | Table 5B-5N Optional 65 |

| A-II | 7, 8 | Taxable Turnover | Reconciled Taxable Turnover vs. GSTR-9 Taxable Turnover | Differences in treatment of Exempt/Nil/Non-GST supplies, RCM supplies not paid, Valuation differences. | Dependent on Table 5 |

| A-III | 9, 10, 11 | Tax Paid | Rate-wise liability (Reconciled) vs. GSTR-9 Liability | Rate classification errors, incorrect tax calculation, RCM liability mismatch, non-payment of liability identified during reconciliation. | Mandatory |

| A-IV | 12, 13 | Net ITC | ITC per Books/Audited Financials vs. Net ITC per GSTR-9 | ITC booked but not claimed (or vice-versa), Timing differences, Ineligible ITC booked, Reversal differences, ITC claimed under wrong head. | Table 12B, 12C Optional 72 |

| A-IV | 14, 15 | Expense-wise ITC | ITC on Expenses (Books) vs. Total ITC per GSTR-9 | Difficulty in mapping expenses to ITC, Capital Goods ITC treatment, Allocation of common credits across GSTINs, Ineligible credits included in expenses. | Table 14 Optional 63 |

| A-IV | 16 | Additional ITC Reversal | Liability arising from ITC reconciliation | Excess ITC claimed identified during reconciliation. | Mandatory |

6.4 Optional Fields and Relaxations

As highlighted in the table above and supported by sources 63, several fields and tables within GSTR-9C, particularly those involving detailed adjustments (Table 5B-5N) or complex reconciliations like expense-wise ITC (Table 14), have been made optional for various financial years. This aims to reduce the compliance burden associated with granular reconciliation, focusing instead on the key headline figures of turnover, tax, and net ITC.

6.5 Implications of GSTR-9C

The transition from CA/CMA certification to self-certification for GSTR-9C represents a fundamental shift in responsibility.56 While this may reduce compliance costs for businesses (by eliminating mandatory professional certification fees), it places the entire onus for the accuracy and correctness of the reconciliation statement squarely on the taxpayer. Any errors, omissions, or misrepresentations discovered later by tax authorities could lead to direct consequences for the taxpayer, including interest, penalties, and potential legal action, without the buffer of professional certification.

Despite the move to self-certification, GSTR-9C remains a potent compliance enforcement tool for the tax administration.65 It mandates a formal comparison between the taxpayer’s financial reporting (audited statements) and their GST compliance record (GSTR-9). Significant unreconciled differences flagged in GSTR-9C serve as clear indicators of potential non-compliance or revenue leakage, making these returns prime candidates for departmental scrutiny, audit selection, and further investigation.

A significant practical challenge inherent in GSTR-9C preparation stems from the need to reconcile PAN-level financial data with GSTIN-level GST returns.70 Audited financial statements typically consolidate the operations of an entire legal entity (under one PAN), whereas GSTR-9 and GSTR-9C are filed for each individual GST registration (GSTIN). Extracting and accurately apportioning PAN-level figures (like total turnover, specific expenses for ITC reconciliation) to the relevant GSTIN requires robust internal accounting mechanisms and can be particularly complex for multi-locational businesses with shared services or inter-unit transactions, potentially leading to estimations or unreconciled items.

Section 7: First Return (Section 40)

7.1 Legal Requirement for Reporting Pre-Registration Supplies

Section 40 of the CGST Act addresses the specific situation of supplies made by a person in the period after they become liable to register for GST but before they are actually granted the registration certificate. The provision mandates that every newly registered person must declare all outward supplies made during this interim period – specifically, the period between the date on which their liability to register arose (e.g., crossing the turnover threshold) and the date on which the registration was formally granted.79 This declaration must be included in the very first return that the taxpayer furnishes after the grant of registration.79

7.2 Procedure and Timelines

Compliance with Section 40 typically involves including these past supplies (made during the liability-to-grant period) in the regular GSTR-1 (for outward supply details) and GSTR-3B (for summary liability and tax payment) filed for the first tax period following the grant of registration.67 For instance, if registration is granted in February for a liability that arose in January, the January supplies would be reported in the February GSTR-1 and GSTR-3B.

However, a practical difficulty can arise. The GST portal’s validation checks might prevent the entry of invoice dates in GSTR-1 that fall before the effective date of registration mentioned in the certificate.82 This system constraint can conflict with the legal requirement under Section 40 to report these earlier supplies. Taxpayers facing this issue may need to contact the GST helpdesk for resolution or explore legally permissible workarounds, such as potentially amending invoice dates if feasible, though this should be approached with caution.82

7.3 Issuance of Revised Invoices

Closely related to Section 40 is the provision for issuing revised invoices under Section 31(3)(a) of the CGST Act. This section permits a newly registered person to issue revised tax invoices against the original invoices that were issued during the period between the effective date of registration and the date of issuance of the registration certificate.82 These revised invoices must be issued within one month from the date the registration certificate is issued.82

The purpose of revised invoices is crucial: they allow the recipient of these supplies to claim ITC. The original invoices issued during the pre-certificate period (even if post-liability) would typically lack the supplier’s GSTIN and would not be valid documents for the recipient to claim credit. The revised invoice, containing the supplier’s GSTIN and other prescribed details 83, rectifies this, enabling the credit flow corresponding to the supplies declared by the supplier in their first return under Section 40.

7.4 Implications of Section 40

Section 40 serves a vital function by bridging the compliance gap that can occur during the registration process.79 Since liability to pay GST arises from the date a person becomes liable to register (not necessarily the date registration is granted), Section 40 ensures that the tax on supplies made during this interim period is properly accounted for and declared, preventing potential revenue loss to the exchequer.

Furthermore, the interplay between Section 40 (supplier’s declaration) and Section 31(3)(a) (supplier issuing revised invoices) is critical for enabling the continuity of the Input Tax Credit chain.82 It ensures that recipients who procured goods or services from the supplier during this specific pre-registration grant period can legitimately claim ITC once the supplier fulfills their obligations under Section 40 and issues the necessary revised invoices. Without these provisions, the credit flow would be broken for transactions occurring during the registration processing time.

Despite its clear intent, the potential practical hurdle related to portal restrictions on backdating invoices 82 highlights an occasional disconnect between legislative provisions and system implementation. This can necessitate additional effort from taxpayers to ensure compliance, potentially requiring interaction with GSTN support or seeking professional advice on handling such situations.

Section 8: Final Return (Section 45 – GSTR-10)

8.1 Applicability upon Registration Cancellation

When a registered person’s GST registration is either cancelled by the tax authorities or voluntarily surrendered by the taxpayer, Section 45 of the CGST Act mandates the filing of a Final Return in Form GSTR-10.81 This return serves as the concluding compliance step for the taxpayer under that specific GST registration.

Exceptions: The requirement to file GSTR-10 does not apply to all registered persons. Specifically excluded are Input Service Distributors (ISDs), Non-resident taxable persons (NRTPs), persons required to deduct TDS under Section 51, persons required to collect TCS under Section 52, and taxpayers registered under the Composition Scheme (Section 10).88 These categories often have different closure or final reporting mechanisms.

8.2 Due Date and Filing Procedure

Due Date: Form GSTR-10 must be filed electronically within three months from the effective date of cancellation or the date of the cancellation order issued by the proper officer, whichever date is later.84 While this is the statutory timeline, the government has, in the past, provided extensions or amnesty schemes with reduced late fees for filing pending GSTR-10s.86

Prerequisites: Before a taxpayer can file GSTR-10, they must ensure that all other applicable pending returns under the GST Act, such as GSTR-1, GSTR-3B, and any applicable annual returns (GSTR-9), have been filed up to the date of cancellation.85 The system typically prevents the filing of GSTR-10 if prior returns are outstanding.

Filing Mode and Access: GSTR-10 is filed electronically on the common GST portal.86 An offline utility is also available to facilitate preparation.88 The link to file the Final Return (Services > Returns > Final Return) only becomes accessible to the taxpayer after their application for cancellation has been approved and an order issued, or after a suo motu cancellation order has been issued by the tax authorities.88 The taxpayer’s login credentials remain active post-cancellation to allow for the completion of this final compliance requirement.88

8.3 Content Requirements (Closing Stock, ITC Reversal)

The primary purpose of GSTR-10 is to ensure that the taxpayer accounts for the GST liability associated with the stock of goods held at the time of cancellation.85 Section 29(5) of the CGST Act requires a person whose registration is cancelled to pay an amount equivalent to the Input Tax Credit (ITC) taken in respect of:

- Inputs held in stock

- Inputs contained in semi-finished or finished goods held in stock

- Capital goods or plant and machinery

…on the day immediately preceding the date of cancellation, OR the output tax payable on such goods, whichever is higher.

GSTR-10 facilitates this requirement by capturing:

- Details of Closing Stock: The form requires taxpayers to declare the particulars of their closing stock as of the cancellation date, categorized into inputs as such, inputs in semi-finished/finished goods, and capital goods/machinery. Details are required separately for stock where invoices are available versus where invoices are not available.85

- Calculation and Payment of ITC Reversal/Tax: Based on the stock details, the taxpayer must calculate the amount of ITC to be reversed or the output tax payable (whichever is higher) as per Section 29(5). This calculated amount must be paid by debiting the electronic credit ledger or electronic cash ledger.85 GSTR-10 cannot be filed without discharging this liability in full.88

- Certification: For significant values of stock/ITC involved, certification by a Chartered Accountant or Cost Accountant might be required (often linked to the requirements similar to Form ITC-03, though specific GSTR-10 instructions prevail).85

- Other Details: The form also captures basic details (GSTIN, names, address), cancellation order details, tax payment details (CGST, SGST, IGST, Cess), and details of any interest or late fee paid.85

Nil Return: If the taxpayer has no stock of inputs, semi-finished goods, finished goods, or capital goods carrying ITC on the date of cancellation, a Nil GSTR-10 can be filed.85

8.4 Consequences of Non-Filing

Failure to file GSTR-10 within the stipulated three-month period attracts specific consequences:

- Notice: The proper officer is required to issue a notice in Form GSTR-3A to the defaulting taxpayer, directing them to file the final return within 15 days of receiving the notice.89

- Best Judgment Assessment: If the taxpayer fails to file GSTR-10 even after the notice period expires, the proper officer is empowered under Section 62 to proceed with a best judgment assessment. An assessment order in Form GST ASMT-13 will be issued, determining the taxpayer’s liability under Section 29(5) based on the information available to the officer.89

- Late Fees: Late filing of GSTR-10 attracts late fees as per Section 47(1).86 The standard fee is Rs. 100 per day under CGST and Rs. 100 per day under SGST/UTGST (total Rs. 200 per day), subject to a maximum cap of Rs. 5,000 under each Act (total Rs. 10,000).39 As mentioned earlier, amnesty schemes have periodically reduced this burden.86

GSTR-10 fundamentally acts as the final settlement mechanism under GST for an exiting taxpayer.85 Its core purpose is to ensure that any potential undue benefit derived from ITC claimed on goods remaining in stock at the point of exit is neutralized. Since ITC is availed on the premise that goods will be used for making taxable supplies, the cancellation breaks this chain. Section 29(5), operationalized through GSTR-10, mandates the reversal or payment of tax corresponding to this stock, effectively closing the loop on the credit claimed.

From a procedural standpoint, filing GSTR-10 represents the formal closure of GST compliance obligations for that registration.88 Non-filing leaves the taxpayer’s record incomplete in the GST system and triggers further departmental action, including notices and potentially unfavorable best judgment assessments. Therefore, timely filing is essential for a clean exit from the GST regime. There is also an important interplay with the cancellation process itself. While the liability under Section 29(5) needs to be discharged, official clarifications indicate that this payment is not necessarily a prerequisite for applying for cancellation but must be settled by the time GSTR-10 is filed within its three-month deadline.89 This sequencing allows the administrative process of cancellation to proceed while ensuring the final financial settlement occurs within a defined timeframe.

Section 9: Consequences of Late Furnishing of Returns

Failure to furnish GST returns by their respective due dates triggers specific, often automatic, consequences under the CGST Act, primarily in the form of late fees and interest charges. These levies are intended to ensure timely compliance, which is critical for the smooth functioning of the interconnected GST system, particularly the flow of Input Tax Credit.

9.1 Levy of Late Fees (Section 47)

Section 47 of the CGST Act provides the statutory basis for the levy of late fees for delayed filing of various returns.86

- Applicability: Late fees are applicable for delays in filing returns required under:

- Section 37 (GSTR-1)

- Section 39 (GSTR-3B, GSTR-4, GSTR-5, GSTR-6, GSTR-7)

- Section 44 (GSTR-9 / GSTR-9C)

- Section 45 (GSTR-10 – Final Return)

- Section 52 (GSTR-8 – TCS return) (Note: Section 38 is omitted as GSTR-2 is not operational).

- Nature of Levy: The levy under Section 47 is generally considered mandatory and automatic upon delay.95 The language “shall pay a late fee” signifies a statutory obligation.95 Taxpayers typically cannot waive this fee themselves; waiver requires a specific notification by the Government under Section 128.92

- Calculation Basis: The late fee is calculated on a per-day basis for the period of delay, starting from the day after the due date until the return is actually filed. The fee is levied separately under the CGST Act and the respective SGST/UTGST Act, effectively doubling the per-day amount mentioned in the CGST Act alone.92

Rationalized Late Fee Structure: While Section 47(1) initially prescribed a standard fee (Rs. 100 CGST + Rs. 100 SGST/UTGST per day), the government has significantly rationalized these fees through various notifications, introducing lower caps based on turnover and whether the return filed is a Nil return.

Summary of Late Fees for Key GST Returns (Post-Rationalization)

| Return Form | Filing Type / Turnover Threshold (AATO) | Late Fee per Day (CGST + SGST/UTGST) | Maximum Late Fee Cap (CGST + SGST/UTGST) | Supporting Snippets |

| GSTR-1, GSTR-3B | Nil Return | Rs. 20 (10+10) | Rs. 500 (250+250) | 6 |

| Other than Nil / AATO ≤ Rs 1.5 Cr | Rs. 50 (25+25) | Rs. 2,000 (1000+1000) | 6 | |

| Other than Nil / AATO > Rs 1.5 Cr to ≤ Rs 5 Cr | Rs. 50 (25+25) | Rs. 5,000 (2500+2500) | 6 | |

| Other than Nil / AATO > Rs 5 Cr | Rs. 50 (25+25) | Rs. 10,000 (5000+5000) | 6 | |

| GSTR-4 (Annual) | Nil Return | Rs. 20 (10+10) | Rs. 500 (250+250) | 6 |

| Other than Nil | Rs. 50 (25+25) | Rs. 2,000 (1000+1000) | 6 | |

| GSTR-7 (TDS) | Nil Return | No Fee | Not Applicable | 6 |

| Other than Nil | Rs. 50 (25+25) | Rs. 2,000 (1000+1000) | 6 | |

| GSTR-9 (Annual) | AATO ≤ Rs 5 Cr | Rs. 50 (25+25) | 0.04% of Turnover in State/UT | 6 |

| AATO > Rs 5 Cr to ≤ Rs 20 Cr | Rs. 100 (50+50) | 0.04% of Turnover in State/UT | 6 | |

| AATO > Rs 20 Cr | Rs. 200 (100+100) | 0.50% of Turnover in State/UT | 6 | |

| GSTR-9C | Applicable (AATO > Rs 5 Cr) | Not Applicable Separately | Fee levied on GSTR-9 until 9C is filed | 68 |

| GSTR-10 (Final) | Any | Rs. 200 (100+100) | Rs. 10,000 (5000+5000) | 39 |

(Note: Fees are effective from dates specified in notifications, e.g., GSTR-1/3B rationalization from June 2021, GSTR-9 from FY 22-23. Always refer to current notifications.)

- Payment: Late fees are generally auto-calculated by the GST portal upon filing the delayed return and must be paid through the electronic cash ledger.92 Filing of the return is typically blocked until the late fee is paid.

9.2 Interest on Delayed Tax Payment (Section 50)

Separate from late fees (which are for delayed filing), Section 50 imposes interest for the delayed payment of tax liability.33

- Trigger: Interest applies when a taxpayer liable to pay tax fails to pay it (or any part) to the government within the prescribed period (i.e., the due date for payment, usually linked to the GSTR-3B due date).33

- Interest Rates:

- For delay in paying tax liability: Interest is levied at a rate not exceeding 18% per annum (the currently notified rate is 18%).33

- For wrongly availed AND utilised Input Tax Credit, or for undue/excess reduction in output tax liability: Interest is levied at a rate not exceeding 24% per annum (the currently notified rate is 24%).6 The Finance Act, 2022 clarified that for wrongly availed ITC, interest under Section 50(3) applies only when such credit is utilised.96

- Calculation Period: Interest is calculated from the day succeeding the due date of payment until the date the tax is actually paid.96

- Calculation Basis (Net vs. Gross Liability): This was a significant point of contention. Initially, interest was often demanded on the gross tax liability declared in GSTR-3B, without netting off the available ITC.

- The Proviso to Section 50(1): Amendments introduced a crucial proviso clarifying that for tax payable related to supplies declared in a GSTR-3B filed after the due date, interest under Section 50(1) is applicable only on the portion of the tax that is paid by debiting the electronic cash ledger.33 This means interest is calculated on the net cash liability after utilising available ITC.

- Retrospective Effect: Following GST Council recommendations 100, this principle of charging interest on net liability was given retrospective effect from July 1, 2017, via amendments and CBIC instructions, providing major relief to taxpayers.96

- Exception: The benefit of net interest calculation does not apply if the return (GSTR-3B) is filed after the initiation of recovery proceedings under Section 73 (non-fraud cases) or Section 74 (fraud cases). In such scenarios, interest remains payable on the gross tax liability.33

- Payment: Interest liability is generally self-assessed by the taxpayer and must be paid voluntarily, usually through the electronic cash ledger.33 While the portal might auto-calculate some interest (e.g., in Table 5.1 of GSTR-3B based on previous return data 33), taxpayers must ensure the correct amount is calculated and paid based on the actual delay and applicable rate.

The clarification regarding interest calculation on net tax liability was a landmark change.33 It acknowledged the principle that ITC available in the electronic credit ledger represents tax already paid to the government (via suppliers) and should logically be considered before calculating interest on delayed payment of the final output liability. This significantly reduced the financial burden associated with minor delays in GSTR-3B filing, especially for businesses with substantial ITC claims.

9.3 Other Potential Consequences

Beyond monetary levies, delayed or non-filing of returns can trigger a cascade of other adverse consequences, severely impacting business operations:

- Blocking of E-Way Bill Generation: As per Rule 138E, if a taxpayer fails to file GSTR-3B for two consecutive tax periods (or GSTR-1/CMP-08 as applicable), their ability to generate e-way bills for movement of goods can be blocked.6

- Blocking of GSTR-1 Filing: As discussed under Section 1, Rule 59(6) prevents the filing of GSTR-1/IFF if the GSTR-3B for the preceding tax period(s) is pending.4

- Suspension and Cancellation of Registration: Persistent failure to furnish returns is grounds for suspension (Rule 21A) and subsequent cancellation of GST registration under Section 29. Typically, non-filing of GSTR-3B for a continuous period of six months triggers this action.31

- Impact on Recipient’s ITC: A supplier’s failure to file returns (especially GSTR-1) and pay taxes directly impacts their recipients’ ability to claim ITC, potentially leading to restrictions under Section 38.19

- Recovery Proceedings: If taxes, interest, or fees remain unpaid despite notices, the department can initiate recovery proceedings under Section 79 to recover the dues through various means.95

This interconnectedness of consequences demonstrates the GST system’s design to enforce compliance sequentially. A failure at one stage (e.g., GSTR-3B filing/payment) triggers restrictions and penalties that escalate, creating significant pressure on taxpayers to adhere to deadlines and maintain good compliance standing.4

Section 10: Real-Life Based Problems and Practical Challenges

Despite the intended simplification and automation, navigating the GST return filing process under Sections 37-47 presents numerous practical challenges and real-life problems for businesses in India. These often stem from data inconsistencies, system limitations, interpretation issues, and the sheer volume of compliance requirements.

10.1 Reconciliation Complexities