1. Introduction

1.1. Purpose and Definition of Assessment under GST

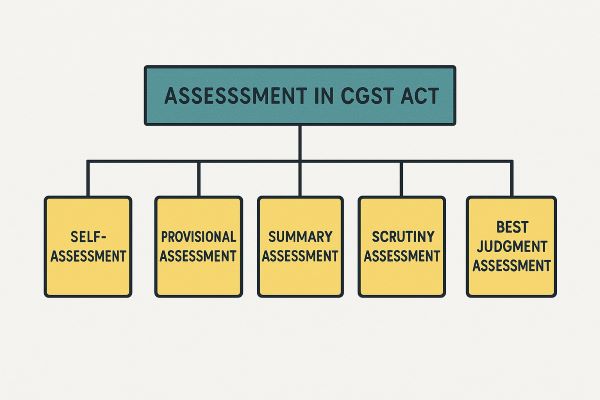

The Central Goods and Services Tax (CGST) Act, 2017, establishes a comprehensive framework for the levy and collection of tax on intra-State supplies of goods or services or both. A critical component of this framework is the process of ‘assessment’, which, as defined under Section 2(11) of the CGST Act, means the determination of tax liability under the Act.1 This definition explicitly includes various types of assessments: self-assessment, re-assessment, provisional assessment, summary assessment, and best judgment assessment.1 Assessment under GST serves multiple purposes: it ensures taxpayer compliance with tax laws, facilitates the correct calculation and payment of tax liabilities, helps detect errors or discrepancies, and prevents tax evasion.9 Adjudication proceedings, which involve deciding or settling disputes related to assessment or penalties, are integral to this process, ensuring principles of natural justice, such as the opportunity to be heard, are observed.1

1.2. Scope of the Report

This report provides an in-depth analysis of specific assessment mechanisms stipulated under Chapter XII of the CGST Act, 2017, focusing on Sections 59, 60, 62, 63, and 64. These sections cover:

- Section 59: Self-Assessment

- Section 60: Provisional Assessment

- Section 62: Assessment of Non-filers of Returns (a form of Best Judgement Assessment)

- Section 63: Assessment of Unregistered Persons (a form of Best Judgement Assessment)

- Section 64: Summary Assessment in Certain Special Cases

The analysis will delve into the legal provisions of these sections, the circumstances under which each assessment type is applicable, the procedural requirements mandated by the CGST Rules (primarily Rules 98, 99, and 100), the associated forms (Forms GST ASMT-01 to ASMT-18), time limits, taxpayer obligations and rights, and the consequences of non-compliance. Furthermore, the report will include a comparative analysis to highlight the key distinctions between these assessment types. Understanding these provisions is crucial for tax professionals and businesses navigating the complexities of GST compliance and administration in India.

2. Official Text: CGST Act Sections 59, 60, 62, 63, & 64

The following is the official text of the relevant sections of the Central Goods and Services Tax Act, 2017, as amended 11:

Section 59. Self-assessment.

Every registered person shall self-assess the taxes payable under this Act and furnish a return for each tax period as specified under section 39.

Section 60. Provisional assessment.

(1) Subject to the provisions of sub-section (2), where the taxable person is unable to…source goods and/or services supplied is essential, as GST rates vary based on classification.14

2. Calculate Taxable Turnover: The taxpayer must compute the aggregate value of all taxable supplies made during the tax period.14

3. Compute Tax Payable: Based on the turnover and applicable rates, the taxpayer calculates the total tax liability, including CGST, SGST/UTGST, IGST, and any applicable cess.14

4. Claim Eligible Input Tax Credit (ITC): Taxpayers must determine the amount of ITC they are eligible to claim on inward supplies used for business purposes, ensuring compliance with conditions under Section 16 and related rules.14

5. Maintain Accurate Records: Maintaining transparent, accurate, and updated records of all transactions (inward and outward supplies, ITC availed, tax paid) is crucial for accurate self-assessment.1

6. Furnish Returns: The self-assessed tax liability, after adjusting for ITC, must be reported by furnishing the prescribed returns under Section 39 (e.g., Form GSTR-1 for outward supplies, Form GSTR-3B summary return) for each tax period (monthly or quarterly, as applicable) within the stipulated due dates.4

7. Pay Tax: The self-assessed tax must be paid by the due date for filing the return (typically GSTR-3B).4

The return filed based on self-assessment is legally binding.14 Any omission or incorrect particular discovered later (other than through scrutiny, audit, etc.) must be rectified in the return for the period during which it is noticed, subject to payment of interest and time limits specified (typically the due date for the September return following the end of the financial year or the date of filing the annual return, whichever is earlier).5

3.3. Consequences of Incorrect Self-Assessment

While self-assessment relies on taxpayer declaration, it is not unsupervised.5 Incorrect self-assessment can lead to several adverse consequences 14:

- Interest: Underpayment of tax attracts interest under Section 50.14

- Penalties: Penalties may be levied under various sections (e.g., Section 122) for short payment, non-payment, incorrect ITC claims, suppression, etc..14

- Scrutiny and Audits: Inconsistent, inaccurate, or suspicious data in returns can trigger scrutiny under Section 61 or audits under Section 65 (by tax authorities) or Section 66 (special audit).4

- Demand Proceedings: Significant discrepancies can lead to demand notices under Section 73 (non-fraud cases) or Section 74 (fraud cases).

- Blocking of ITC: Incorrectly claimed ITC may be reversed, leading to additional tax liability plus interest and penalties.14

The burden of proving the correctness of the self-assessment lies with the taxpayer.15

3.4. Foundational Role and Trigger Mechanism

Section 59 is not merely one type of assessment among others; it represents the default and foundational mechanism for determining tax liability under GST.5 The entire compliance structure hinges on the taxpayer fulfilling their self-assessment obligations correctly and timely.

Crucially, the failure or inadequacy of self-assessment acts as the primary trigger for various subsequent actions by the tax authorities. For instance:

- Scrutiny of Returns (Section 61): This is initiated to verify the correctness of the self-assessed return filed under Section 39.3

- Assessment of Non-filers (Section 62): This is invoked specifically when the self-assessment process fails entirely, i.e., the registered person fails to furnish the return required under Section 39 or 45, even after notice.2

- Audit by Tax Authorities (Section 65) / Special Audit (Section 66): These are undertaken to examine records and verify the correctness of turnover declared, taxes paid, refunds claimed, and ITC availed – essentially verifying the accuracy of the self-assessment over a period.3

- Demand and Recovery (Sections 73/74): These proceedings are typically initiated when scrutiny, audit, or other intelligence reveals that tax has been short-paid, not paid, erroneously refunded, or ITC wrongly availed/utilized due to errors or fraud in the self-assessment process.

This structure clearly demonstrates that while GST starts with a trust-based self-assessment, the law provides robust mechanisms for departmental intervention, verification, and enforcement precisely when self-assessment falters or raises red flags.

4. Section 60 & Rule 98: Provisional Assessment – Navigating Uncertainty

4.1. Triggering Conditions

Section 60 provides a mechanism for assessment on a provisional basis, but unlike other assessments initiated by the tax authorities, this is invoked at the request of the taxable person.1 This option is available only under specific circumstances of genuine uncertainty where the taxable person is unable to determine either:

- The value of goods or services or both, or

- The applicable rate of tax.1

Situations involving ambiguity in transaction value, uncertainty about tax rates due to complex classification issues, composite supplies, or industry-specific complexities might warrant a request for provisional assessment.29 This facility cannot be extended for any other purpose.6

4.2. Procedural Steps (Rule 98)

The procedure for obtaining provisional assessment is detailed in Rule 98 of the CGST Rules, 2017, and involves specific forms:

- Application: The registered person must submit an application electronically on the common portal in FORM GST ASMT-01. This application must include the reasons for requesting provisional assessment and be accompanied by supporting documents.6 A single application can cover more than one good or service.32

- Notice for Information (Optional): Upon receiving the application, the Proper Officer (PO) may, if necessary, issue a notice in FORM GST ASMT-02 requiring the applicant to furnish additional information or documents, or to appear in person.6

- Reply to Notice: The applicant must file a reply to the notice (if issued) in FORM GST ASMT-03 and may appear in person before the PO if desired.9

- Provisional Assessment Order: The PO must pass an order within 90 days from the date of receipt of the request (FORM GST ASMT-01). This order, issued in FORM GST ASMT-04, will either allow the payment of tax on a provisional basis or reject the application (though some sources suggest rejection is not an option for the PO at this stage 6). If allowed, the order specifies the value and/or rate for provisional assessment and the amount for which a bond and security must be furnished.6

4.3. Bond and Security Requirements (Section 60(2) & Rule 98(4))

A key condition for allowing provisional assessment is the execution of a bond and furnishing of security:

- Bond: The taxable person must execute a bond in FORM GST ASMT-05. This bond legally binds the person to pay the difference between the finally assessed tax and the provisionally assessed tax.2 The bond amount covers the potential differential tax liability (including CGST, SGST/UTGST, IGST, and cess).30 A bond furnished under the SGST Act or IGST Act is deemed sufficient for CGST purposes.31

- Security: Along with the bond, the PO may require security, typically in the form of a bank guarantee.3 The amount of security cannot exceed 25% of the amount covered by the bond.3

This requirement ensures that the government’s revenue is protected during the period of uncertainty while the final liability is being determined.

4.4. Finalization Process (Section 60(3) & Rule 98(5))

The provisional assessment must eventually be finalized:

- Notice for Finalization: The PO issues a notice in FORM GST ASMT-06, calling for the information and records necessary to finalize the assessment.18

- Final Assessment Order: After considering the information, the PO passes the final assessment order in FORM GST ASMT-07. This order specifies the final amount payable by the registered person or the amount refundable, if any.2

4.5. Time Limits and Extensions for Finalization (Section 60(3))

The final assessment order (FORM GST ASMT-07) must be passed within six months from the date of communication of the provisional assessment order (FORM GST ASMT-04).6

However, extensions are possible if sufficient cause is shown and reasons are recorded in writing:

- Joint Commissioner (JC) / Additional Commissioner (AC): Can extend the period by a further six months.6

- Commissioner: Can grant a further extension for a period not exceeding four years.6 This implies a maximum possible period of 5 years for the finalization of a provisional assessment.30

4.6. Interest Implications (Section 60(4) & 60(5))

Interest calculations ensure the time value of money is accounted for:

- Interest Payable (Section 60(4)): If the final assessment determines a higher tax liability than what was paid provisionally, the registered person is liable to pay interest on the shortfall. Interest is calculated at the rate specified under Section 50(1) (currently 18% per annum 34) from the original due date of payment (under Section 39(7)) until the date of actual payment of the differential amount, regardless of whether payment occurs before or after the final assessment order.6

- Interest Receivable (Section 60(5)): If the final assessment results in a refund for the taxpayer (i.e., provisional tax paid was higher), interest is payable on the refund amount. This interest is calculated at the rate specified under Section 56 (currently 6% per annum 34) and is subject to the provisions of Section 54(8) (related to unjust enrichment). Interest typically starts from the date after 60 days from the date of receipt of the refund application until the date of refund, provided the refund is not made within those 60 days.6

4.7. Security Release (Rule 98(6) & 98(7))

Once the final assessment order (FORM GST ASMT-07) is issued and the amount finally determined as payable is paid by the taxpayer:

- Application for Release: The taxpayer can file an application in FORM GST ASMT-08 for the release of the security furnished earlier.6

- Order for Release: The PO, after ensuring that the applicant has paid the amount specified in the final assessment order, shall release the security and issue an order in FORM GST ASMT-09 within seven working days from the date of receipt of the application.6

4.8. Table: Provisional Assessment Forms (Rule 98)

| Form | Purpose | Rule Ref | Relevant Snippets |

| GST ASMT-01 | Application for Provisional Assessment | 98(1) | 6 |

| GST ASMT-02 | Notice seeking additional information | 98(2) | 6 |

| GST ASMT-03 | Reply to Notice ASMT-02 | 98(2) | 9 |

| GST ASMT-04 | Order allowing Provisional Assessment & specifying Bond/Security | 98(3) | 6 |

| GST ASMT-05 | Bond/Bank Guarantee for Provisional Assessment | 98(4) | 2 |

| GST ASMT-06 | Notice for Finalization of Assessment | 98(5) | 18 |

| GST ASMT-07 | Final Assessment Order (Provisional) | 98(5) | 2 |

| GST ASMT-08 | Application for Release of Security | 98(6) | 6 |

| GST ASMT-09 | Order for Release/Rejection of Security Release Application | 98(7) | 6 |

4.9. Balancing Taxpayer Relief and Revenue Security

The provisional assessment mechanism under Section 60 represents a careful balancing act by the legislature. On one hand, it provides essential relief to taxpayers facing genuine difficulties in determining value or rate, preventing business disruptions and potential penalties arising from incorrect self-assessment.29 The requirement for the taxpayer to initiate the process and provide reasons ensures it is used for legitimate uncertainty.6 On the other hand, the mandatory execution of a bond and the provision of security (up to 25% of the bond amount) act as crucial safeguards for government revenue.2 This ensures that even while granting flexibility to the taxpayer, the potential difference in tax liability is secured. Furthermore, the application of interest on both shortfalls and refunds ensures financial neutrality and compensates for the time value of money.6 This structure reflects a pragmatic approach, facilitating compliance in complex situations while diligently protecting the interests of the exchequer.

5. Section 62 & Rule 100(1): Assessment of Non-Filers – Addressing Non-Compliance

5.1. Conditions for Invocation

Section 62 of the CGST Act provides a specific mechanism for assessing registered persons who fail to comply with their return filing obligations. This section, which overrides the general demand provisions of Section 73 and Section 74 for this specific default 6, is invoked when a registered person fails to furnish:

- The return required under Section 39 (which covers regular monthly/quarterly returns like GSTR-3B), or

- The final return required under Section 45 (FORM GSTR-10, filed upon cancellation of registration).

Crucially, Section 62 applies only after the registered person has failed to file the return despite being served a notice under Section 46 (Notice to Return Defaulter, commonly issued in FORM GSTR-3A, giving 15 days to file).2 It does not apply to non-filing of other statements like GSTR-1 or the annual return GSTR-9.6

5.2. Best Judgement Assessment Basis

When the conditions for invoking Section 62 are met, the Proper Officer (PO) is empowered to assess the tax liability of the defaulting registered person to the “best of his judgement”.2 This means the PO will estimate the liability based on the information available. The PO must take into account all relevant material which is available or which has been gathered.6 Such material could include:

- Details of outward supplies from FORM GSTR-1 filed by the taxpayer.28

- Details of inward supplies auto-populated in FORM GSTR-2A/2B.28

- Information available from e-way bills generated.28

- Data from third-party sources or intelligence units.

- Information gathered during any inspection conducted under Section 71.28

The assessment aims to arrive at a reasonable estimate of the tax liability in the absence of the taxpayer’s own declaration via the return.

5.3. Procedural Aspects and Time Limit (Rule 100(1))

The procedure under Section 62, as supplemented by Rule 100(1) of the CGST Rules, involves:

- Assessment Order: The PO issues the best judgment assessment order in FORM GST ASMT-13.3 This order quantifies the tax liability assessed by the PO.

- Summary Upload: A summary of this order must be uploaded electronically by the PO in FORM GST DRC-07 (Summary of Order).3 This ensures the demand is reflected in the electronic liability register.

- Time Limit: The assessment order under Section 62 must be issued within five years from the date specified under Section 44 for furnishing the annual return for the financial year to which the unpaid tax relates.3

5.4. Withdrawal Mechanism and Effect of Subsequent Filing (Section 62(2))

Section 62(2) provides a crucial opportunity for the taxpayer to rectify the non-filing and have the best judgment assessment order withdrawn:

- Initial Window (60 Days): If the registered person furnishes a “valid return” within 60 days (this period was 30 days prior to the amendment effective from 1st October 2023) of the service of the assessment order (FORM GST ASMT-13), the said assessment order is deemed to have been withdrawn.2 A “valid return” is generally understood to mean the return filed along with the payment of the self-assessed tax declared therein.25

- Extended Window (Additional 60 Days – Post Amendment): A proviso added to Section 62(2) (effective 1st October 2023) provides further relief. If the registered person fails to file the valid return within the initial 60 days, they may furnish it within a further period of 60 days (i.e., between the 61st and 120th day from the service of ASMT-13). However, this extension is conditional upon payment of an additional late fee of ₹100 per day (₹50 CGST + ₹50 SGST) for the period of delay beyond the initial 60 days. If the valid return is furnished within this extended 120-day period along with the additional late fee, the assessment order (ASMT-13) is still deemed to be withdrawn.11

This withdrawal mechanism strongly incentivizes the taxpayer to eventually file the missing return, even after a best judgment assessment has been initiated.

5.5. Continuing Liability for Interest and Late Fees

It is critical to note that even when the assessment order (FORM GST ASMT-13) is deemed withdrawn upon filing the valid return (within either the 60-day or the extended 120-day period), the taxpayer’s liability does not cease entirely. The liability for payment of:

- Interest under Section 50(1) on the tax due from the original due date, and

- Late fee under Section 47 for the delay in filing the return, shall continue.2 Additionally, if the extended 120-day window is utilized, the additional late fee prescribed in the proviso to Section 62(2) must also be paid.11

If the taxpayer fails to file the valid return even within the extended 120-day period (where applicable), the best judgment assessment order (ASMT-13) becomes final, and the PO may initiate recovery proceedings under Section 78 and 79.13

5.6. Table: Assessment of Non-Filers Forms (Section 62 / Rule 100(1))

| Form | Purpose | Rule Ref | Relevant Snippets |

| GST ASMT-13 | Best Judgement Assessment Order (Non-Filer) | 100(1) | 3 |

| GST DRC-07 | Summary of Order (uploaded electronically) | 100(1) | 3 |

5.7. Compliance Encouragement over Punishment (with Caveats)

The structure of Section 62, particularly the deemed withdrawal provision in sub-section (2) and its recent expansion via the proviso 11, reflects a legislative intent focused more on encouraging eventual compliance (i.e., getting the return filed) rather than solely on punishing the non-filing through potentially high-pitched best judgment assessments. The primary trigger is the failure to file after notice 2, and the principal remedy offered within the section itself is to file the return.2 This prioritizes bringing the taxpayer back into the regular reporting system. However, the mechanism is not without consequences. The insistence on the continuation of liability for interest and late fees 2, plus the additional late fee for using the extended window 11, serves as a necessary deterrent against casual non-compliance and compensates the government for the delayed revenue and administrative effort.

6. Section 63 & Rule 100(2): Assessment of Unregistered Persons – Bringing into the Tax Net

6.1. Applicability

Section 63 addresses situations where a person is liable to pay GST but is not operating within the formal registration framework. This section, like Section 62, overrides Sections 73 and 74 for the specific assessment it covers.11 It applies specifically to a taxable person who:

- Fails to obtain registration under GST even though they are liable to do so according to Section 22 (turnover thresholds) or Section 24 (mandatory registration cases).2

- Whose registration has been cancelled by the proper officer under Section 29(2) (due to reasons like contravention of provisions, non-filing of returns for continuous periods, not commencing business, obtaining registration by fraud, etc.), but who was liable to pay tax during the period before or after cancellation.3

This section empowers the tax authorities to assess and demand tax from those operating outside the registration system or whose registration was cancelled due to non-compliance, ensuring they cannot escape their tax obligations.

6.2. Best Judgement Assessment Basis

Similar to Section 62, the assessment under Section 63 is made on a “best of his judgement” basis by the Proper Officer (PO).2 Since the person is unregistered or their registration is cancelled, the PO typically lacks returns filed by the taxpayer. Therefore, the PO relies on whatever relevant information or material is available or gathered through surveys, inspections, intelligence, third-party data, etc., to estimate the tax liability for the relevant tax periods.22

6.3. Procedure (Rule 100(2))

The procedure for assessment under Section 63, outlined in Rule 100(2), incorporates principles of natural justice:

- Notice: The PO must issue a notice to the taxable person in FORM GST ASMT-14. This notice must contain the grounds on which the assessment is proposed to be made on a best judgment basis.3

- Summary of Notice: A summary of the notice (FORM GST ASMT-14) must also be served electronically in FORM GST DRC-01 (Summary of Show Cause Notice).3

- Opportunity to Reply: The notice must allow the person a time of fifteen days to furnish a reply, if any.3

- Opportunity of Being Heard: Crucially, the proviso to Section 63 mandates that no assessment order shall be passed without giving the person an opportunity of being heard.3 This is a mandatory procedural safeguard.

- Assessment Order: After considering the reply (if any) and providing a hearing, the PO passes the best judgment assessment order in FORM GST ASMT-15.3

- Summary of Order: A summary of the final order (FORM GST ASMT-15) is uploaded electronically in FORM GST DRC-07.3

6.4. Time Limit for Assessment

The assessment order under Section 63 must be issued within five years from the date specified under Section 44 for furnishing the annual return for the financial year to which the tax not paid relates.3

6.5. Table: Assessment of Unregistered Persons Forms (Section 63 / Rule 100(2))

| Form | Purpose | Rule Ref | Relevant Snippets |

| GST ASMT-14 | Notice for Best Judgement Assessment (Unregistered Person) | 100(2) | 3 |

| GST DRC-01 | Summary of Show Cause Notice (served electronically) | 100(2) | 3 |

| GST ASMT-15 | Best Judgement Assessment Order (Unregistered Person) | 100(2) | 3 |

| GST DRC-07 | Summary of Order (uploaded electronically) | 100(2) | 3 |

6.6. Procedural Fairness for Non-Registrants

A significant aspect of Section 63 is the explicit inclusion of the principle of natural justice, even for persons who have failed to comply with registration requirements. The mandatory requirement for the PO to provide an opportunity of being heard before passing the best judgment assessment order ensures a degree of procedural fairness.3 While the assessment itself relies on the PO’s judgment due to the absence of taxpayer-submitted data, the law guarantees the affected person a chance to present their case, submit evidence, and contest the grounds of assessment before a final liability is determined. This contrasts with Section 62, where the primary statutory recourse provided after the order is the filing of the return, although natural justice principles might still guide the PO’s actions before issuing the ASMT-13. This specific safeguard in Section 63 acknowledges that even non-compliant individuals deserve a fair hearing before an assessment order is finalized against them.

7. Section 64 & Rule 100(3)-(5): Summary Assessment – Protecting Revenue Interests

7.1. Special Circumstances for Invocation

Section 64 provides for Summary Assessment, a mechanism distinct from other assessment types due to its specific trigger and purpose. It is considered an exceptional measure, often referred to as a ‘protective assessment’, designed for situations demanding swift action to safeguard government revenue.2 Invocation requires the fulfillment of two conditions:

- Evidence of Tax Liability: The Proper Officer (PO) must possess evidence that shows a tax liability of a person has come to their notice.3 The assessment must be based on this evidence, not mere opinion.58

- Threat to Revenue: The PO must have sufficient grounds to believe that any delay in issuing an assessment order may adversely affect the interest of revenue.3 This implies a sense of urgency, where immediate assessment is deemed necessary to prevent potential loss of tax, penalty, or interest.58

This assessment can be initiated against any person, irrespective of whether they have filed returns.58

7.2. Procedural Requirements

The procedure for summary assessment reflects its expedited and protective nature:

- Prior Permission Mandatory: A crucial prerequisite is that the PO must obtain the previous permission of the Additional Commissioner (AC) or Joint Commissioner (JC) before proceeding with the summary assessment.3 The PO cannot initiate summary assessment suo moto without this higher-level approval.58 This acts as a significant check on the use of this power.

- Assessment Order: Once permission is granted, the PO proceeds to assess the tax liability based on the available evidence and issues the assessment order directly in FORM GST ASMT-16.3 Unlike other assessments, there is no requirement for a prior show-cause notice or opportunity of hearing before issuing the ASMT-16 order under Section 64(1).

- Summary Upload: A summary of the order (FORM GST ASMT-16) must be uploaded electronically by the PO in FORM GST DRC-07.3

7.3. Deemed Taxable Person (Goods)

Section 64 includes a unique deeming provision specifically for the supply of goods. If the taxable person to whom the liability pertains cannot be ascertained (e.g., goods found abandoned, in transit without proper ownership documentation, or stored in a warehouse with unclear ownership), the person in charge of such goods shall be deemed to be the taxable person.3 This person-in-charge will then be assessed and held liable to pay the tax and any other amount due under the summary assessment order. It is important to note that this deeming provision does not apply if the unascertained liability relates to the supply of services.58

7.4. Withdrawal Process (Section 64(2), Rule 100(4), 100(5))

Recognizing the potentially harsh nature of an assessment made without prior hearing, Section 64(2) provides a recourse for the taxpayer and an oversight mechanism:

- Application by Taxable Person: The person against whom the summary assessment order (FORM GST ASMT-16) is issued can apply for its withdrawal. This application must be made in FORM GST ASMT-17 within 30 days from the date of receipt of the order.3

- Suo Moto Withdrawal by AC/JC: The Additional Commissioner or Joint Commissioner (the same level of authority whose permission was required to initiate the assessment) can also, on their own motion (suo moto), withdraw the summary assessment order if they consider it to be erroneous.11

- Consequence of Withdrawal: If the summary assessment order is withdrawn (either on application or suo moto), the PO must then follow the regular procedures for determination of tax laid down in Section 73 (determination of tax in non-fraud cases) or Section 74 (determination of tax in fraud/suppression cases), as applicable.7 This means a proper show-cause notice process will follow.

- Order of Withdrawal/Rejection: The order withdrawing the summary assessment or rejecting the taxpayer’s application for withdrawal is issued in FORM GST ASMT-18.3

7.5. Table: Summary Assessment Forms (Section 64 / Rule 100(3)-(5))

| Form | Purpose | Rule Ref | Relevant Snippets |

| GST ASMT-16 | Summary Assessment Order | 100(3) | 3 |

| GST DRC-07 | Summary of Order (uploaded electronically) | 100(3) | 3 |

| GST ASMT-17 | Application for Withdrawal of Summary Assessment Order | 100(4) | 3 |

| GST ASMT-18 | Order of Withdrawal/Rejection of Withdrawal Application | 100(5) | 3 |

7.6. Urgency and Higher Oversight

Summary Assessment under Section 64 stands apart from other assessment types due to its inherent urgency and the built-in higher-level oversight. Unlike assessments triggered by taxpayer requests (Sec 60), non-compliance (Sec 62), or registration status (Sec 63), Section 64 is activated by the PO’s perception of an imminent threat to revenue, based on tangible evidence.3 This focus on immediacy justifies the departure from the usual pre-assessment notice and hearing procedures. However, to prevent arbitrary use of this potent tool, the law mandates prior permission from a senior officer (AC/JC) before the PO can issue the summary assessment order.3 This requirement acts as a crucial safeguard. Furthermore, the power to withdraw an erroneous summary assessment order also rests with the AC/JC, reinforcing this structure of control and oversight by higher authorities over this exceptional assessment power.11

8. Comparative Analysis of Assessment Types (Sections 59, 60, 62, 63, 64)

To provide a clear understanding of the distinct roles and applications of the assessment mechanisms discussed, the following table compares them across key parameters:

8.1. Table: Comparative Overview of GST Assessments (Sec 59, 60, 62, 63, 64)

| Feature | Section 59: Self-Assessment | Section 60: Provisional Assessment | Section 62: Non-Filers Assessment | Section 63: Unregistered Persons Assessment | Section 64: Summary Assessment |

| Applicability | Every Registered Person | Registered Person (on request) | Registered Person | Taxable Person (Unregistered/Cancelled Reg.) | Any Person (incl. deemed person for goods) |

| Trigger/Condition | Mandatory for every tax period | Inability to determine Value/Rate | Failure to file return (Sec 39/45) post-notice (Sec 46) | Liable but not registered / Reg. Cancelled (Sec 29(2)) with tax liability | Evidence of liability & threat to revenue interest |

| Basis of Assessment | Taxpayer’s own calculation | PO specifies provisional Value/Rate | PO’s Best Judgement | PO’s Best Judgement | PO’s assessment based on evidence |

| Initiated By | Taxpayer | Taxpayer (Request) | Proper Officer | Proper Officer | Proper Officer (with AC/JC permission) |

| Key Forms | GSTR-1, GSTR-3B, etc. (Sec 39 Returns) | ASMT-01 to ASMT-09 | ASMT-13, DRC-07 | ASMT-14, DRC-01, ASMT-15, DRC-07 | ASMT-16, DRC-07, ASMT-17, ASMT-18 |

| Time Limit for Order | N/A (Return Filing Due Dates) | Provisional: 90 days; Final: 6 months (Extensible up to 5 years) | 5 years from Annual Return due date | 5 years from Annual Return due date | No specific time limit mentioned (Urgency) |

| Taxpayer Recourse/ Obligation | Correct self-assessment & timely filing | Execute Bond/Security; Apply for finalization/release | File valid return (60/120 days) for withdrawal | Opportunity of being heard; Reply to notice | Apply for withdrawal (30 days) |

(Note: Forms mentioned are key forms associated with the core assessment process under the respective section/rule. PO = Proper Officer, AC = Additional Commissioner, JC = Joint Commissioner)

8.2. Narrative Explanation of Key Distinctions

The table highlights several fundamental differences between these assessment types:

- Self vs. Departmental: Section 59 is unique as it is performed by the taxpayer themselves, forming the base of the GST system. Sections 60, 62, 63, and 64 involve assessment actions initiated or finalized by the Proper Officer, albeit under different circumstances and procedures.1

- Initiation: Self-assessment (Sec 59) is mandatory and taxpayer-driven. Provisional assessment (Sec 60) is taxpayer-initiated through a request. Assessments under Sections 62, 63, and 64 are initiated by the tax authorities, although Section 64 requires prior permission from higher authorities.2

- Circumstances: Each assessment addresses a specific situation: routine compliance (Sec 59), taxpayer uncertainty (Sec 60), failure to file returns (Sec 62), operating outside registration (Sec 63), and urgent revenue protection (Sec 64).2

- Basis of Assessment: The foundation ranges from the taxpayer’s own calculation (Sec 59), to a mutually agreed provisional basis (Sec 60), to the officer’s best judgment based on available information (Sec 62, 63), and finally to assessment based on specific evidence indicating liability and risk (Sec 64).2

- Taxpayer Recourse: The avenues for taxpayer recourse vary significantly. Self-assessment errors are primarily rectified through subsequent returns.5 Provisional assessment involves participation in finalization.29 For non-filers (Sec 62), the main recourse is filing the return to get the order withdrawn.13 Unregistered persons (Sec 63) are guaranteed an opportunity to be heard before the order.49 Summary assessment (Sec 64) allows an application for withdrawal post-order, judged by higher authorities.58

9. Conclusion

The assessment framework under the CGST Act, 2017, particularly Sections 59, 60, 62, 63, and 64, establishes a multi-faceted approach to determining tax liability. The system is fundamentally anchored in Section 59: Self-Assessment, placing the primary responsibility of calculation, reporting, and payment of tax on the registered person. This reflects a trust-based compliance model aimed at efficiency.5

However, the Act provides robust mechanisms for situations where self-assessment is not feasible, fails, or requires intervention. Section 60: Provisional Assessment offers a structured path for taxpayers facing genuine uncertainty regarding valuation or tax rates, balancing relief with revenue security through bonds and interest provisions.29

Addressing non-compliance, Section 62: Assessment of Non-filers empowers authorities to use best judgment when registered persons fail to file returns despite notice, while simultaneously encouraging eventual compliance through a withdrawal mechanism linked to subsequent filing.13 Similarly, Section 63: Assessment of Unregistered Persons ensures that those operating outside the registration net or whose registration is cancelled are brought to account, again using best judgment but incorporating procedural fairness through the mandatory opportunity of being heard.49

Finally, Section 64: Summary Assessment serves as an exceptional power, enabling swift action based on evidence when revenue is perceived to be at immediate risk, subject to crucial oversight and permission from higher authorities.58

Collectively, these assessment provisions demonstrate a comprehensive strategy: reliance on taxpayer declaration as the default, specific solutions for uncertainty and non-compliance, and protective measures for urgent situations. The procedural rules (Rules 98, 100) and prescribed forms (ASMT-01 to ASMT-18) provide the operational framework for these assessments. Accurate self-assessment and timely compliance remain the most effective way for taxpayers to navigate the GST system and avoid triggering these departmental assessment procedures and their associated financial and administrative consequences. The effective implementation and fair application of these assessment mechanisms are critical to maintaining the integrity and efficiency of the Goods and Services Tax regime in India.

Works cited

- ADJUDICATION AND ASSESSMENT IN GST – Tax Management India. Com, https://www.taxmanagementindia.com/visitor/detail_article.asp?ArticleID=12184

- All About Assessment Under GST – VJM Global, https://vjmglobal.com/blog/assessment-under-gst/

- Various Assessment Schemes under GST – Cayugalgoyal.com, https://cayugalgoyal.com/resource/Image/Various%20Assessment%20Schemes%20under%20GST.pdf

- Assessment Under GST Types: Self, Provisional & Scrutiny – Tax2win, https://tax2win.in/guide/assessment-gst

- Section-59 Self Assessment Under GST – TaxGuru, https://taxguru.in/goods-and-service-tax/section-59-assessment-gst.html

- Assessment under GST | Section 59 to 64 | CGST Act, 2017 – TaxGuru, https://taxguru.in/goods-and-service-tax/assessment-gst-section-59-64-cgst-act-2017.html

- Assessments under GST | Section 59 to 64 | CGST Act, 2017 – TaxGuru, https://taxguru.in/goods-and-service-tax/assessments-gst-section-59-64-cgst-act-2017.html

- ASSESSMENTS IN GST – Voice of CA, https://www.voiceofca.in/siteadmin/document/AssessmentsinGSTbyCAAshokBatra.pdf

- Comprehensive Guide to GST Self-Assessment and Procedures – TaxGuru, https://taxguru.in/goods-and-service-tax/comprehensive-guide-gst-self-assessment-procedures.html

- E-Book on Demand & Adjudication GST & Legacy – NACIN, https://www.nacin.gov.in/ZCVisakhapatnam/Images/Documents/EBooks/E-Book%20on%20Demand%20&%20Adjudication%20GST%20&%20Legacy.pdf

- idtc-icai.s3-ap-southeast-1.amazonaws.com, https://idtc-icai.s3-ap-southeast-1.amazonaws.com/download/pdf23/GST-Act(s)-and-Rule(s)-Bare-Law-(20-04-2023).pdf

- cbic-gst.gov.in, https://cbic-gst.gov.in/pdf/CGST-Act-Updated-30092020.pdf

- Assessment of Non-Filers of GST Returns – Section 62 of GST, https://ardhorajiya.com/assessment-of-non-filers-of-gst-returns-section-62-of-gst/

- Self-Assessment of GST – Section 59 of GST, https://ardhorajiya.com/self-assessment-of-gst-section-59-of-gst/

- Self Assessment (Section 59) – GST Ready Reckoner – Tax Management India. Com, https://www.taxmanagementindia.com/visitor/detail_manual.asp?ID=2649

- What is Form GST ASMT-10 | Handling and Responding to Form ASMT-10 – IRIS GST, https://irisgst.com/what-is-form-gst-asmt-10-handling-and-responding-to-form-asmt-10/

- Assessment – cloudfront.net, https://d23z1tp9il9etb.cloudfront.net/download/pdf24/13.%20Assessment.pdf

- Assessment in the GST Law – AIFTP, https://aiftponline.org/journal/2018/september-2018/assessment-in-the-gst-law/

- Section 59: Self-assessment of Tax under GST – FINACT Professional Services, https://www.finactservices.com/section-59-self-assessment-of-tax-under-gst/

- cgst rule 99 scrutiny of returns – ClearTax, https://cleartax.in/v/gst/gst-rules/cgst-rule-99-scrutiny-of-returns/

- Rule 99 : Scrutiny of Returns – CGGST, https://www.cggst.com/wp-content/uploads/2023/07/Rule-99-3.pdf

- Overview of GST Assessment Procedure – Metalegal Advocates, https://www.metalegal.in/post/overview-of-gst-assessment-procedure

- Implications of Non-Compliance with GST Return Filing under Section 62 of CGST Act, https://www.nyca.in/implications-of-non-compliance-with-gst-return-filing-under-section-62-of-cgst-act/

- Section 62: Assessment of non-filers of GST returns – FINACT Professional Services, https://www.finactservices.com/section-62-assessment-of-non-filers-of-gst-returns/

- Best Judgement Assessment under GST – ClearTax, https://cleartax.in/s/judgement-assessment-under-gst

- Section 62 CGST – Assessment of non-filers of returns – Chapter XII CG – Teachoo, https://www.teachoo.com/5872/1923/Section-62-CGST—Assessment-of-non-filers-of-returns/category/Chapter-XII-CGST-Assessment-(Section-59-to-64)/

- All about Section 62 of the CGST Act – Super CA, https://superca.in/blogs/all-about-section-62-of-the-cgst-act

- Central Circulars on Miscellaneous Issues (Updated up to 31.12.2023) – Directorate of Commercial Taxes, West Bengal, https://comtax.wb.gov.in/GST/GST_PPU/Compilation%20of%20Misc%20circulars%20up%20to%2031-12-2023.pdf

- Provisional Assessment – Section 60 of GST, https://ardhorajiya.com/provisional-assessment-section-60-of-gst/

- Provisional Assessment section 60 – GST Ready Reckoner – Tax Management India. Com, https://www.taxmanagementindia.com/visitor/detail_manual.asp?ID=2646

- PROVISIONAL ASSESSMENT – Handbook of GST Law & Procedures (CBIC) October 2024, https://www.taxmanagementindia.com/visitor/detail_manual.asp?ID=7625

- Taxpublishers.in – Provisional Assessment Under GST—Law and Procedure—CA. Satyadev Purohit, https://taxpublishers.in/ShowGST?ITPJ_Art782?m0

- Assessment procedure in GST with Brief of Act, Rules & Forms – TaxGuru, https://taxguru.in/goods-and-service-tax/assessment-procedure-gst-act-rules-forms.html

- Easy GST Guide to Section 60 for Provisional Assessment – SAG Infotech blog, https://blog.saginfotech.com/gst-section-60-provisional-assessment

- CGST ACT – Section 60 : Provisional assessment – CGGST, https://www.cggst.com/wp-content/uploads/2017/11/CGGSTActSection-60.pdf

- Section 60 of CGST Act, 2017 – Provisional Assessment – KanoonGPT, https://kanoongpt.in/bare-acts/the-central-goods-and-services-tax-act-2017/chapter-xii-section-60-3480cd6c33854e4c

- Compiler on Section 60 – Provisional assessment under GST, https://gstgyaan.com/compiler-on-section-60-provisional-assessment-under-gst

- Provisional Assessment | CGST Rule 98 – GSTZen, https://gstzen.in/a/provisional-assessment-cgst-rule-98.html

- Filing Application for Provisional Assessment and Release of Security – GSTZen, https://gstzen.in/a/gst-manuals-faq-filing-application-for-provisional-assessment-and-release-of-security.html

- CGST RULES – CGGST, https://www.cggst.com/wp-content/uploads/2017/11/TheCentralGoodsAndServicesTaxRuleRule-98.pdf

- Central Goods and Services Tax (CGST) Rules, 2017 Part – B (FORMS) – CBIC-GST, https://cbic-gst.gov.in/pdf/18052021-CGST-Rules-2017-Part-B-Forms.pdf

- All about GST assessment – CAclubindia, https://www.caclubindia.com/articles/all-about-gst-assessment–33156.asp

- GST Forms Available on the GST Common Portal 1. Registration – Kerala GST, https://keralataxes.gov.in/wp-content/uploads/2019/05/GST_forms_available_25092019.pdf

- GST Forms and Functionalities available on the GST Portal – IRIS GST, https://irisgst.com/gst-updates-new-gst-forms-and-functionalities-available-on-the-gst-portal/

- CGST Rules: Chapter 11 – Assessment and Audit – ClearTax, https://cleartax.in/s/cgst-rules-chapter-11-assessment-and-audit

- Assessment Forms – CGGST, https://www.cggst.com/assessment-forms/

- ASSESSMENT AND AUDIT 1. Provisional Assessment (1) Every registered person requesting for payment of tax on a prov, https://comtax.assam.gov.in/sites/default/files/swf_utility_folder/departments/cot_finance_uneecopscloud_com_oid_18/this_comm/Assessment_Audit_Rules.pdf

- What is a GST Notice?: Unraveling Reasons and Types of GST Notices – Cygnet.One, https://www.cygnet.one/blog/what-is-a-gst-notice-unraveling-reasons-and-types-of-gst-notices/

- Section 63 – Assessment of unregistered persons – GST Gyaan, https://gstgyaan.com/section-63-of-the-cgst-act-assessment-of-unregistered-persons

- Section 63: Assessment of Unregistered persons under GST – FINACT Professional Services, https://www.finactservices.com/section-63-assessment-of-unregistered-persons-under-gst/

- Section 63: Assessment Of Unregistered Persons | The Central Goods and Services Tax Act, 2017 – KanoonGPT, https://kanoongpt.in/bare-acts/the-central-goods-and-services-tax-act-2017/chapter-xii-section-63-b258727a85ed4baf

- cgst rule 100 assessment in certain cases – ClearTax, https://cleartax.in/v/gst/gst-rules/cgst-rule-100-assessment-in-certain-cases/

- Assessment in certain cases | CGST Rule 100 – GST Learn, https://gstlearn.com/2024/01/24/assessment-in-certain-cases-cgst-rule-100/

- 1[Rule 100 : Assessment in certain cases – CGGST, https://www.cggst.com/wp-content/uploads/2023/07/Rule-100-1.pdf

- Assessment in certain cases | Department of Goods and Services Tax, https://mahagst.gov.in/en/assessment-certain-cases

- Best Judgment Assessments for Unregistered or Cancelled GST …, https://taxguru.in/goods-and-service-tax/judgment-assessments-unregistered-cancelled-gst-registrations.html

- Taking Actions during Assessment Proceedings u/s 63 against Unregistered Persons, https://gstzen.in/a/gst-manuals-faq-taking-actions-during-assessment-proceedings-u-s-63-against-unregistered-persons.html

- Summary assessment in certain special cases Section 64 – GST …, https://www.taxmanagementindia.com/visitor/detail_manual.asp?ID=2650

- SUMMARY ASSESSMENT IN GST IN CERTAIN CASES – Tax Management India. Com, https://www.taxmanagementindia.com/visitor/detail_article.asp?ArticleID=10271

- Section 64 – Summary assessment in certain special cases under GST, https://gstgyaan.com/section-64-summary-assessment-in-certain-special-cases-under-gst

- Section 64: Summary Assessment In Certain Special Cases | The Central Goods and Services Tax Act, 2017 – KanoonGPT, https://kanoongpt.in/bare-acts/the-central-goods-and-services-tax-act-2017/chapter-xii-section-64-098fd95a241de36c

- Section 64: Summary assessment in certain special cases of GST, https://www.finactservices.com/section-64-summary-assessment-in-certain-special-cases-of-gst/

- Section 64 – Tax Information – CBIC!, https://taxinformation.cbic.gov.in/content-page/explore-act/1000338/1000001